Proctor and Gamble 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63 The Procter & Gamble Company

Amounts in millions of dollars except per share amounts or as otherwise specified.

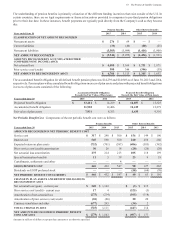

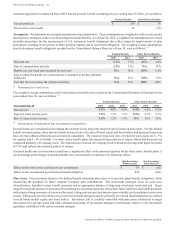

The underfunding of pension benefits is primarily a function of the different funding incentives that exist outside of the U.S. In

certain countries, there are no legal requirements or financial incentives provided to companies to pre-fund pension obligations

prior to their due date. In these instances, benefit payments are typically paid directly from the Company's cash as they become

due.

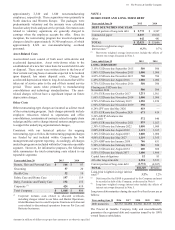

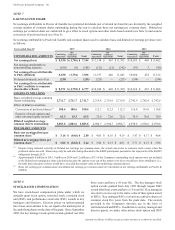

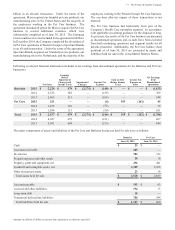

Pension Benefits Other Retiree Benefits

Years ended une 0 2015 2014 2015 2014

CLASSIFICATION OF NET AMOUNT RECOGNIED

Noncurrent assets 2 $ 69

$

Current liabilities 9(40)20(25)

Noncurrent liabilities 5,5(5,984)1,414(1,906)

NET AMOUNT RECOGNIED 5,4$(5,955)1,44$(1,931)

AMOUNTS RECOGNIED IN ACCUMULATED OTHER

COMPREHENSIVE INCOME AOCI

Net actuarial loss 4,4 $ 5,169 1,1 $ 1,871

Prior service cost(credit) 00 344 4(39)

NET AMOUNTS RECOGNIED IN AOCI 4, $ 5,513 1,5 $ 1,832

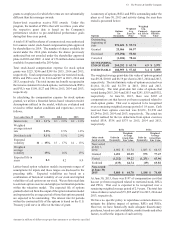

The accumulated benefit obligation for all defined benefit pension plans was $14,239 and $14,949 as of June 30, 2015 and 2014,

respectively. Pension plans with accumulated benefit obligations in excess of plan assets and plans with projected benefit obligations

in excess of plan assets consisted of the following:

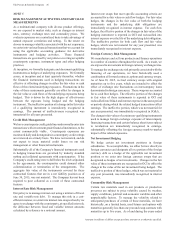

Accumulated Benefit Oligation

Exceeds the Fair Value of Plan Assets

Proected Benefit Oligation

Exceeds the Fair Value of Plan Assets

Years ended une 0 2015 2014 2015 2014

Projected benefit obligation 1,411 $ 14,229 14,05 $ 15,325

Accumulated benefit obligation 11,91 12,406 12,419 13,279

Fair value of plan assets ,91 8,353 ,45 9,301

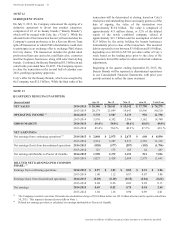

et eoc enet ost. Components of the net periodic benefit cost were as follows:

Pension Benefits Other Retiree Benefits

Years ended une 0 2015 2014 201 2015 2014 201

AMOUNTS RECOGNIED IN NET PERIODIC BENEFIT COST

Service cost 1 $ 298 $ 300 15 $ 149 $ 190

Interest cost 545 590 560 240 256 260

Expected return on plan assets 2(701)(587)40(385)(382)

Prior service cost(credit) amortization 0 26 18 20(20)(20)

Net actuarial loss amortization 25 214 213 105 118 199

Special termination benefits 11 5 39 2 9 18

Curtailments, settlements and other 4

GROSS BENEFIT COST 44 432 547 9 127 265

Dividends on ESOP preferred stock 5(64)(70)

NET PERIODIC BENEFIT COSTCREDIT 44 $ 432 $ 547 40 $ 63 $ 195

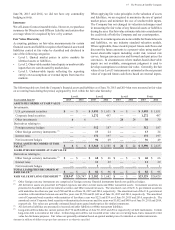

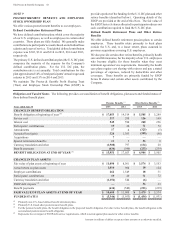

CHANGE IN PLAN ASSETS AND BENEFIT OBLIGATIONS

RECOGNIED IN AOCI

Net actuarial loss(gain) - current year 240 $ 1,102 $ 215

Prior service cost(credit) - current year 1 425(5)

Amortization of net actuarial loss 25(214)105(118)

Amortization of prior service (cost)credit 0(26)20 20

Currency translation and other 245 42

TOTAL CHANGE IN AOCI 251,111 44114

NET AMOUNTS RECOGNIED IN PERIODIC BENEFIT

COST AND AOCI 29$ 1,543 40$ 177