Proctor and Gamble 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 28

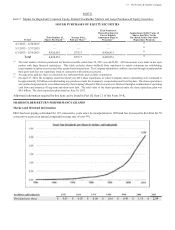

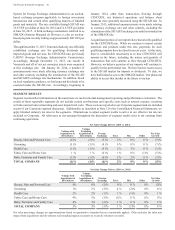

Fiscal year 2014 compared with fiscal year 2013

Gross margin contracted 100 basis points to 49.1 of net sales

in 2014. The decrease in gross margin was primarily driven

by a 150 basis point impact from unfavorable geographic and

product mix, a 50 basis point impact from higher commodity

costs and a 90 basis point impact from unfavorable foreign

exchange, partially offset by manufacturing cost savings of 190

basis points and a 40 basis point benefit from higher pricing.

The unfavorable geographic and product mix was caused by

disproportionate growth in developing regions and the Fabric

Care and Home Care and aby, Feminine and Family Care

segments, which have lower gross margins than the Company

average.

Total SG&A decreased 5 to $24.8 billion in 2014 due to a

reduction in marketing spending, overhead expense,

impairment charges and restructuring costs. SG&A as a

percentage of net sales decreased 170 basis points to 30.8.

Lower restructuring spending drove 30 basis points of the

decline. Marketing spending as a percentage of net sales

decreased 80 basis points primarily due to lower spending

behind a focus on more efficient marketing support and scale

benefits from increased net sales. Overhead spending

decreased 50 basis points from productivity savings.

Impairment charges were 40 basis points in 2013, but were

zero in 2014. Charges for the 2014 foreign currency policy

changes in enezuela were comparable to the 2013 enezuela

devaluation impact.

During fiscal 2013, we incurred impairment charges of $308

million ($290 million after tax) related to the carrying value

of goodwill in our Appliances business and the related raun

trade name intangible asset.

Non-Oerating Items

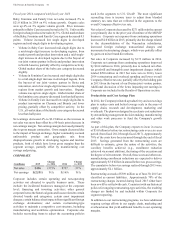

Fiscal year 2015 compared with fiscal year 2014

Interest expense was $626 million in 2015, a decrease of $84

million versus the prior year due to lower average debt balances

and a decrease in weighted average interest rates. Interest

income was $151 million in 2015, an increase of $50 million

versus the prior year due to an increase in cash, cash equivalents

and investment securities. Other non-operating income, net,

primarily includes divestiture gains and investment income.

Other non-operating income increased $325 million to $531

million, primarily due to minor brand divestiture gains. In

2015, we had approximately $400 million in minor brand

divestiture gains, including est, Camay, Fekkai and ash &

Go hair care brands, Rochas and Laura iagotti fine fragrance

brands and aposteam. The prior year acquisition and

divestiture activities included approximately $150 million in

divestiture gains, primarily related to the sale of our bleach

businesses in Europe, IMEA and Latin America, our Pert hair

care business in Latin America and MDIP.

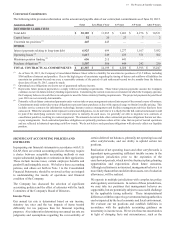

Fiscal year 2014 compared with fiscal year 2013

Interest expense increased 6 in 2014 to $710 million,

primarily due to an increase in average debt outstanding.

Interest income was $101 million in 2014, an increase of $13

million versus the prior year due to an increase in cash, cash

equivalents and investment securities. Other non-operating

income, net, primarily includes divestiture gains and

investment income. Other non-operating income decreased

$735 million to $206 million, primarily due to acquisition and

divestiture impacts. In 2014, we had approximately $150

million in divestiture gains, primarily related to the sale of our

bleach businesses in Europe, IMEA and Latin America, our

Pert hair care business in Latin America and MDIP. The 2013

acquisition and divestiture activities included a $631 million

holding gain resulting from P&G's purchase of the balance of

its aby Care and Feminine Care joint venture in Iberia and

an approximate $250 million gain from the divestiture of our

Italy bleach business.

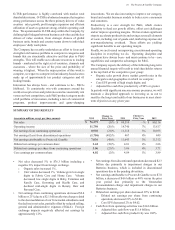

Income Taxes

Fiscal year 2015 compared with fiscal year 2014

The effective tax rate on continuing operations increased 350

basis points to 24.6 in 2015 mainly due to the non-

deductibility of the $2.0 billion enezuelan deconsolidation

charge. The rate increase caused by lower current year

favorable discrete adjustments related to uncertain income tax

positions (the net benefit was 80 basis points in the current year

versus 160 basis points in the prior year) was largely offset by

a decrease related to favorable geographic earnings mix.

Fiscal year 2014 compared with fiscal year 2013

The effective tax rate on continuing operations decreased 170

basis points to 21.1 in 2014. The primary driver of this rate

decline was approximately 320 basis points from the favorable

geographic mix of earnings and approximately 60 basis points

due to the non-deductibility of the 2013 impairment charges

related to our Appliances business. These impacts were

partially offset by a 50 basis point increase due to the enezuela

currency policy changes and devaluation discussed below

(which decreased the prior year rate 20 basis points and

increased the current year rate by 30 basis points), a 110 basis

point increase due to the tax impacts of acquisition and

divestiture activities (the gains from the purchase of the balance

of the aby Care and Feminine Care joint venture in Iberia and

the sale of our Italy bleach business in 2013) and a 30 basis

point increase due to the net impact of favorable discrete

adjustments related to uncertain income tax positions. The net

benefit 2014 was $228 million, or 160 basis points, versus 190

basis points of net benefit in 2013.

Net Earnings

Fiscal year 2015 compared with fiscal year 2014

Net earnings from continuing operations decreased $2.4 billion

or 21 to $8.9 billion due to the $2.1 billion after tax charge

related to the deconsolidation of enezuelan subsidiaries and

the decline in net sales, partially offset by reduced selling,

general and administrative costs (SG&A). Foreign exchange

impacts negatively affected net earnings by approximately

$1.4 billion in 2015 due to the weakening of certain key

currencies against the U.S. dollar, primarily in Russia, Ukraine,

enezuela and Argentina, partially offset by lower after-tax

charges related to balance sheet remeasurement charges in

enezuela.