Proctor and Gamble 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 60

Amounts in millions of dollars except per share amounts or as otherwise specified.

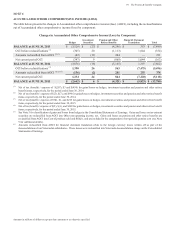

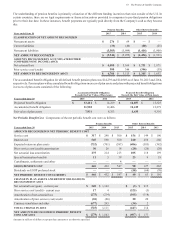

EARNINGS PER SHARE

Net earnings attributable to Procter & Gamble less preferred dividends (net of related tax benefits) are divided by the weighted

average number of common shares outstanding during the year to calculate basic net earnings per common share. Diluted net

earnings per common share are calculated to give effect to stock options and other stock-based awards (see Note 8) and assume

conversion of preferred stock (see Note 9).

Net earnings attributable to Procter & Gamble and common shares used to calculate basic and diluted net earnings per share were

as follows:

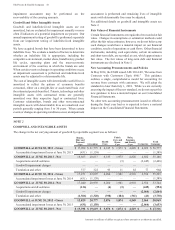

Years ended une 0 2015 2014 201

CONSOLIDATED AMOUNTS Continuing

Oerations

Dis-

continued

Oerations Total Continuing

Oerations

Dis-

continued

Oerations Total Continuing

Oerations

Dis-

continued

Oerations Total

Net earningsloss ,90 1, ,144 $11,318 $ 467 $ 11,785 $ 10,953 $ 449 $11,402

Net earnings attributable to

noncontrolling interests (100) (8) (108)(121)(21)(142)(93)3

(90)

Net earningsloss attriutale

to P&G Diluted ,0 1,94 ,0 11,197 446 11,643 10,860 452 11,312

Preferred dividends, net of tax 259 259(253)

(253)(244)

(244)

Net earningsloss attriutale

to P&G aailale to common

shareholders Basic ,51 1,94 , $ 10,944 $ 446 $ 11,390 $ 10,616 $ 452 $ 11,068

SHARES IN MILLIONS

asic weighted average common

shares outstanding 2,11. 2,11. 2,11. 2,719.8 2,719.8 2,719.8 2,742.9 2,742.9 2,742.9

Effect of dilutive securities

Conversion of preferred shares(1) 10. 10. 10. 112.3 112.3 112.3 116.8 116.8 116.8

Exercise of stock options and

other unvested equity awards (2) . . . 72.6 72.6 72.6 70.9 70.9 70.9

Diluted weighted aerage

common shares outstanding 2,. 2,. 2,. 2,904.7 2,904.7 2,904.7 2,930.6 2,930.6 2,930.6

PER SHARE AMOUNTS

Basic net earningsloss er

common share .1 0. 2.50 $ 4.03 $ 0.16 $ 4.19 $ 3.87 $ 0.17 $ 4.04

Diluted net earningsloss er

common share .0 0.2 2.44 $ 3.86 $ 0.15 $ 4.01 $ 3.71 $ 0.15 $ 3.86

(1) Despite being included currently in Diluted net earnings per common share, the actual conversion to common stock occurs when the

preferred shares are sold. Shares may only be sold after being allocated to the ESOP participants pursuant to the repayment of the ESOP's

obligations through 2035.

(2) Approximately 8 million in 2015, 9 million in 2014 and 12 million in 2013 of the Company's outstanding stock options were not included

in the Diluted net earnings per share calculation because the options were out of the money or to do so would have been antidilutive (i.e.,

the total proceeds upon exercise would have exceeded the market value of the underlying common shares).

(3) asic net earnings per common share and diluted net earnings per common share are calculated on net earnings attributable to Procter &

Gamble.

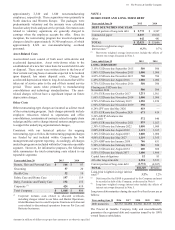

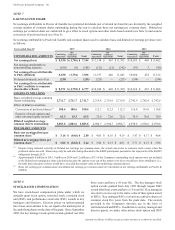

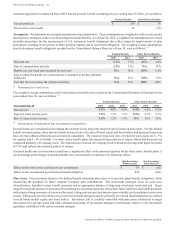

STOCK-BASED COMPENSATION

e have stock-based compensation plans under which we

annually grant stock option, restricted stock, restricted stock

unit (RSU) and performance stock unit (PSU) awards to key

managers and directors. Exercise prices on options granted

have been, and continue to be, set equal to the market price of

the underlying shares on the date of the grant. Since September

2002, the key manager stock option awards granted vest after

three years and have a 10-year life. The key manager stock

option awards granted from July 1998 through August 2002

vested after three years and have a 15-year life. Key managers

can elect to receive up to the entire value of their option award

in RSUs. Key manager RSUs vest and are settled in shares of

common stock five years from the grant date. The awards

provided to the Company's directors are in the form of

restricted stock and RSUs. In addition to our key manager and

director grants, we make other minor stock option and RSU