Proctor and Gamble 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 14

Our usiness is suect to numerous risks as a result of our

haing significant oerations and sales in international

markets, including foreign currenc fluctuations, currenc

exchange or ricing controls and localied olatilit.

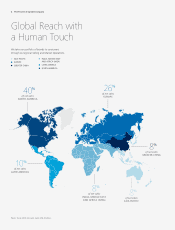

e are a global company, with operations in approximately 70

countries and products sold in more than 180 countries and

territories around the world. e hold assets, incur liabilities,

earn revenues and pay expenses in a variety of currencies other

than the U.S. dollar, and our operations outside the U.S.

generate a significant portion of our net revenue. Fluctuations

in exchange rates for foreign currencies, such as the recent

volatility in the Russian ruble, may reduce the U.S. dollar value

of revenues, profits and cash flows we receive from non-U.S.

markets, increase our supply costs (as measured in U.S. dollars)

in those markets, or otherwise adversely impact our business

results or financial condition. Moreover, discriminatory or

conflicting fiscal policies in different countries could adversely

affect our results. See also the Results of Operations and Cash

Flow, Financial Condition and Liquidity sections of the MD&A

and Note 5 to our Consolidated Financial Statements.

e also have sizable businesses and maintain local currency

cash balances in a number of foreign countries with exchange,

import authorization, pricing or other controls, including

Argentina, China, Egypt, Greece, India, Nigeria, Ukraine and

enezuela. Our results of operations and financial condition

could be adversely impacted if we are unable to successfully

manage such controls and repatriate earnings from overseas,

or if new or increased tariffs, quotas, exchange or price controls,

trade barriers or similar restrictions are imposed on our

business outside the U.S., such as the current year impact of

deconsolidating our enezuelan subsidiaries as discussed in

this Form 10-K.

Additionally, our business, operations or employees may be

affected by political volatility, labor market disruptions or other

crises or vulnerabilities in individual countries or regions,

including political instability or upheaval, broad economic

instability or sovereign risk related to a default by or

deterioration in the credit worthiness of local governments,

particularly in emerging markets, which could negatively

impact our financial condition or results of operations.

Uncertain gloal economic conditions, including

disrutions in credit markets or changes to our credit

rating, ma adersel imact demand for our roducts,

cause our customers and other usiness artners to suffer

financial hardshi or reduce our access to credit, all of

which could adersel imact our usiness.

Our business could be negatively impacted by reduced demand

for our products related to one or more significant local,

regional or global economic disruptions, such as: a slow-down

in the general economy reduced market growth rates tighter

credit markets for our suppliers, vendors or customers or the

inability to conduct day-to-day transactions through our

financial intermediaries to pay funds to or collect funds from

our customers, vendors and suppliers. Additionally, economic

conditions may cause our suppliers, distributors, contractors

or other third party partners to suffer financial difficulties that

they cannot overcome, resulting in their inability to provide us

with the materials and services we need, in which case our

business and results of operations could be adversely affected.

Customers may also suffer financial hardships due to economic

conditions such that their accounts become uncollectible or are

subject to longer collection cycles. If we are unable to generate

sufficient income and cash flow, it could affect the Companys

ability to achieve expected share repurchase and dividend

payments.

Adisruption in the credit markets or a downgrade of our current

credit rating could increase our future borrowing costs and

impair our ability to access capital and credit markets on terms

commercially acceptable to us, which could adversely affect

our liquidity and capital resources or significantly increase our

cost of capital.

Disrution in our gloal sul chain ma negatiel

imact our usiness results.

Our ability to meet our customers needs and achieve cost

targets depends on our ability to maintain key manufacturing

and supply arrangements, including execution of our

previously-announced supply chain simplifications and certain

sole supplier or sole manufacturing plant arrangements. The

loss or disruption of such manufacturing and supply

arrangements, including for issues such as labor disputes, loss

or impairment of key manufacturing sites, inability to procure

sufficient raw or input materials, natural disasters, acts of war

or terrorism or other external factors over which we have no

control, could interrupt product supply and, if not effectively

managed and remedied, have an adverse impact on our

business, financial condition or results of operations.

Our usinesses face cost fluctuations and ressures that

could affect our usiness results.

Our costs are subject to fluctuations, particularly due to changes

in the prices of commodities and raw materials and the costs

of labor, transportation, energy, pension and healthcare.

Therefore, our business results are dependent, in part, on our

continued ability to manage these fluctuations through pricing

actions, cost saving projects and sourcing decisions, while

maintaining and improving margins and market share. In

addition, our financial projections include cost savings

described in our announced productivity plan. Failure to

manage these fluctuations and deliver the planned cost savings

could adversely impact our financial results.

Our ailit to meet our growth targets deends on

successful roduct, marketing and oerations innoation

and successful resonses to cometitie innoation.

e are a consumer products company that relies on continued

global demand for our brands and products. Achieving our

business results depends, in part, on successfully developing,

introducing and marketing new products and on making

significant improvements to our equipment and manufacturing

processes. The success of such innovation depends on our

ability to correctly anticipate customer and consumer

acceptance and trends, to obtain, maintain and enforce

necessary intellectual property protections and to avoid