Proctor and Gamble 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 36

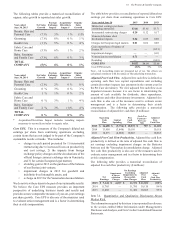

support capacity expansion, innovation and cost efficiencies,

were $3.7 billion in 2015 and $3.8 billion in 2014. Capital

spending as a percentage of net sales increased 10 basis points

to 4.9 in 2015. Capital spending as a percentage of net sales

in 2014 decreased 10 basis points versus 2013 to 4.8.

cstons Acquisition activity was not material in 2015 or

2014.

ocees om Dvesttes n te sset les Proceeds

from asset sales in 2015 contributed $4.5 billion in cash,

primarily from the sale of our Pet Care business, the sale of

our Chinese battery venture, and other minor brand

divestitures. Proceeds from asset sales contributed $570

million in cash in 2014 mainly due to minor brand divestiture

activities, including MDIP, the Pert business in Latin

America and the bleach business in Europe, IMEA and Latin

America.

Financing Cash Flow

Dven ments Our first discretionary use of cash is

dividend payments. Dividends per common share increased

6 to $2.59 per share in 2015. Total dividend payments to

common and preferred shareholders were $7.3 billion in 2015

and $6.9 billion in 2014. In April 2015, the oard of Directors

declared an increase in our quarterly dividend from $0.6436

to $0.6629 per share on Common Stock and Series A and

ESOP Convertible Class A Preferred Stock. This represents a

3 increase compared to the prior quarterly dividend and is

the 59th consecutive year that our dividend has increased. e

have paid a dividend for 125 years, every year since our

incorporation in 1890.

onem n otem Det e maintain debt levels

we consider appropriate after evaluating a number of factors,

including cash flow expectations, cash requirements for

ongoing operations, investment and financing plans (including

acquisitions and share repurchase activities) and the overall

cost of capital. Total debt was $30.4 billion as of June 30, 2015

and $35.4 billion as of June 30, 2014. Our total debt decreased

in 2015 mainly due to debt maturities, partially offset by debt

issuances.

es cses Total share repurchases were $4.6 billion

in 2015 and $6.0 billion in 2014.

Liuidit

At June 30, 2015, our current liabilities exceeded current assets

by $144 million ($2.5 billion, excluding current assets and

current liabilities of the atteries business held for sale), largely

due to short-term borrowings under our commercial paper

program. e anticipate being able to support our short-term

liquidity and operating needs largely through cash generated

from operations. The Company regularly assesses its cash

needs and the available sources to fund these needs. As of June

30, 2015, $11.0 billion of the Companys cash, cash equivalents

and marketable securities is held off-shore by foreign

subsidiaries. Amounts held by foreign subsidiaries are

generally subject to U.S. income taxation on repatriation to the

U.S. e do not expect restrictions or taxes on repatriation of

cash held outside of the U.S. to have a material effect on our

overall liquidity, financial condition or the results of operations

for the foreseeable future. e utilize short- and long-term debt

to fund discretionary items, such as acquisitions and share

repurchases. e have strong short- and long-term debt ratings,

which have enabled and should continue to enable us to

refinance our debt as it becomes due at favorable rates in

commercial paper and bond markets. In addition, we have

agreements with a diverse group of financial institutions that,

if needed, should provide sufficient credit funding to meet

short-term financing requirements.

On June 30, 2015, our short-term credit ratings were P-1

(Moody's) and A-1 (Standard & Poor's), while our long-term

credit ratings are Aa3 (Moody's) and AA- (Standard & Poor's),

all with a stable outlook.

e maintain bank credit facilities to support our ongoing

commercial paper program. The current facility is an $11.0

billion facility split between a $7.0 billion five-year facility

and a $4.0 billion 364-day facility, which expire in August 2018

and July 2016, respectively. The 364-day facility can be

extended for certain periods of time as specified in the terms

of the credit agreement. These facilities are currently undrawn

and we anticipate that they will remain largely undrawn for the

foreseeable future. These credit facilities do not have cross-

default or ratings triggers, nor do they have material adverse

events clauses, except at the time of signing. In addition to

these credit facilities, we have an automatically effective

registration statement on Form S-3 filed with the SEC that is

available for registered offerings of short- or long-term debt

securities. For additional details on debt see Note 4.

Guarantees and Other Off-Balance Sheet Arrangements

e do not have guarantees or other off-balance sheet financing

arrangements, including variable interest entities, which we

believe could have a material impact on financial condition or

liquidity.