Proctor and Gamble 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41 The Procter & Gamble Company

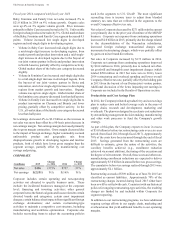

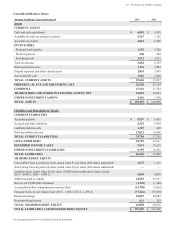

The following tables provide a numerical reconciliation of

organic sales growth to reported net sales growth:

Year ended

une 0, 2015

Net Sales

Growth

Foreign

Exchange

Imact

Acuisition

Diestiture

Imact

Organic

Sales

Growth

eauty, Hair and

Personal Care (7 ) 5 1 (1)

Grooming (7 ) 8 0 1

Health Care (1 ) 5 0 4

Fabric Care and

Home Care (5 ) 6 1 2

aby, Feminine

and Family Care (3 ) 6 0 3

TOTAL

COMPANY 5 0 1

Year ended

une 0, 2014

Net Sales

Growth

Foreign

Exchange

Imact

Acuisition

Diestiture

Imact

Organic

Sales

Growth

eauty, Hair and

Personal Care (2 ) 2 0 0

Grooming 0 3 0 3

Health Care 1 1 0 2

Fabric Care and

Home Care 0 3 1 4

aby, Feminine

and Family Care 2 3 (1) 4

TOTAL

COMPANY 0 0

AcquisitionDivestiture Impact includes rounding impacts

necessary to reconcile net sales to organic sales.

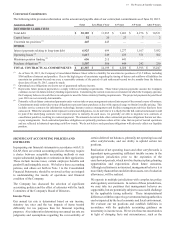

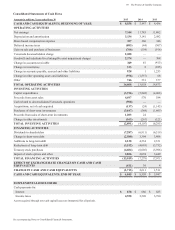

oe This is a measure of the Company's diluted net

earnings per share from continuing operations excluding

certain items that are not judged to be part of the Company's

sustainable results or trends. This includes:

charges in each period presented for 1) incremental

restructuring due to increased focus on productivity

and cost savings, 2) the impacts from foreign

exchange policy changes and the devaluations of the

official foreign currency exchange rate in enezuela,

and 3) for certain European legal matters

a holding gain in 2013 on the purchase of the balance

of our Iberian joint venture

impairment charges in 2013 for goodwill and

indefinite-lived intangible assets and

a charge in 2015 for the enezuelan deconsolidation.

e do not view these items to be part of our sustainable results.

e believe the Core EPS measure provides an important

perspective of underlying business trends and results and

provides a more comparable measure of year-on-year earnings

per share growth. Core EPS is also one of the measures used

to evaluate senior management and is a factor in determining

their at-risk compensation.

The table below provides a reconciliation of reported diluted net

earnings per share from continuing operations to Core EPS:

Years ended une 0 2015 2014 201

Diluted net earnings per share -

continuing operations .0 $3.86 $3.71

Incremental restructuring charges 0.20 0.12 0.17

enezuela balance sheet

devaluation impacts 0.04 0.09 0.08

Charges for European legal matters 0.01 0.02 0.05

Gain on purchase of balance of

Iberian J (0.21)

Impairment charges 0.10

enezuelan deconsolidation 0.1

Rounding (0.01)

CORE EPS 4.02 $4.09 $3.89

Core EPS Growth 2 5 6

Note - All reconciling items are presented net of tax. Tax effects are

calculated consistent with the nature of the underlying transaction.

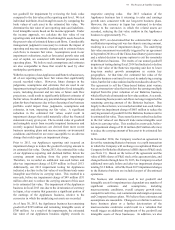

ste ee s lo Adjusted free cash flow is defined as

operating cash flow less capital expenditures and excluding

certain divestiture impacts (tax payments in the current year for

the Pet Care divestiture). e view adjusted free cash flow as an

important measure because it is one factor in determining the

amount of cash available for dividends, share repurchases,

acquisitions and other discretionary investments. Adjusted free

cash flow is also one of the measures used to evaluate senior

management and is a factor in determining their at-risk

compensation. The following table provides a numerical

reconciliation of adjusted free cash flow ($ millions):

Oerating

Cash

Flow

Caital

Sending

Free

Cash

Flow

Cash Tax

Pament -

Pet Care

Sale

Adusted

Free

Cash Flow

2015 14,0 , 10,2 29 11,01

2014 13,958 (3,848) 10,110 10,110

2013 14,873 (4,008) 10,865 10,865

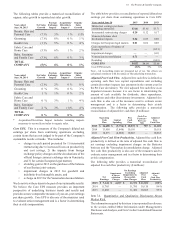

ste ee s lo octvt Adjusted free cash flow

productivity is defined as the ratio of adjusted free cash flow to

net earnings excluding impairment charges on the atteries

business and the enezuelan deconsolidation charge. Adjusted

free cash flow productivity is also one of the measures used to

evaluate senior management and is a factor in determining their

at-risk compensation.

The following table provides a numerical reconciliation of

adjusted free cash flow productivity ($ millions):

Net

Earnings

Imairment

& Decon-

solidation

Charges

Net Earnings

Excluding

Imairment &

Deconsolid-

ation Charges

Adusted

Free

Cash

Flow

Adusted

Free

Cash Flow

Productiit

2015 ,144 4,1 11,1 11,01 102

2014 11,785 11,785 10,110 86

2013 11,402 11,402 10,865 95

Item 7A. uantitative and ualitative Disclosures About

Market Risk.

The information required by this item is incorporated by reference

to the section entitled Other Information under Management's

Disclosure and Analysis, and Note 5 to the Consolidated Financial

Statements.