Proctor and Gamble 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39 The Procter & Gamble Company

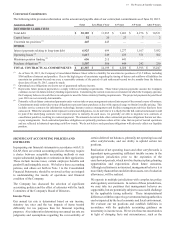

test goodwill for impairment by reviewing the book value

compared to the fair value at the reporting unit level. e test

individual indefinite-lived intangible assets by comparing the

book values of each asset to the estimated fair value. e

determine the fair value of our reporting units and indefinite-

lived intangible assets based on the income approach. Under

the income approach, we calculate the fair value of our

reporting units and indefinite-lived intangible assets based on

the present value of estimated future cash flows. Considerable

management judgment is necessary to evaluate the impact of

operating and macroeconomic changes and to estimate future

cash flows to measure fair value. Assumptions used in our

impairment evaluations, such as forecasted growth rates and

cost of capital, are consistent with internal projections and

operating plans. e believe such assumptions and estimates

are also comparable to those that would be used by other

marketplace participants.

ith the exception of our Appliances and atteries businesses,

all of our reporting units have fair values that significantly

exceed recorded values. However, future changes in the

judgments, assumptions and estimates that are used in our

impairment testing for goodwill and indefinite-lived intangible

assets, including discount and tax rates or future cash flow

projections, could result in significantly different estimates of

the fair values. In addition, any potential change in the strategic

plans for these businesses due to the refocusing of our business

portfolio could impact these judgments, assumptions and

estimates, in turn, impacting our fair value. A significant

reduction in the estimated fair values could result in

impairment charges that could materially affect the financial

statements in any given year. The recorded value of goodwill

and intangible assets from recently impaired businesses and

recently acquired businesses are derived from more recent

business operating plans and macroeconomic environmental

conditions and therefore are more susceptible to an adverse

change that could require an impairment charge.

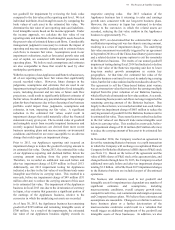

Prior to 2013, our Appliances reporting unit incurred an

impairment charge to reduce the goodwill carrying amount to

its estimated fair value. During 2013, the estimated fair value

of our Appliances reporting unit declined further, below the

carrying amount resulting from the prior impairment.

Therefore, we recorded an additional non-cash before and

after-tax impairment charge of $259 million in fiscal 2013.

Additionally, our 2013 impairment testing for Appliances

indicated a decline in the fair value of our raun trade name

intangible asset below its carrying value. This resulted in a

non-cash, before-tax impairment charge of $49 million ($31

million after-tax) to reduce the carrying amount of this asset

to its estimated fair value. The impairment of the Appliances

business in fiscal 2013 was due to the devaluation of currency

in Japan, a key country that generates a significant portion of

the earnings of the Appliances business, relative to the

currencies in which the underlying net assets are recorded.

As of June 30, 2015, the Appliances business has remaining

goodwill of $299 million and remaining intangible assets of

$706 million. As a result of the impairments, the estimated

fair value of our Appliances business slightly exceeds its

respective carrying value. Our 2015 valuation of the

Appliances business has it returning to sales and earnings

growth rates consistent with our long-term business plans.

However, the currency in Japan has continued to devalue

relative to the currencies in which the related assets are

recorded, reducing the fair value cushion in the Appliances

business to approximately 5.

During 2015, we determined that the estimated fair value of

our atteries reporting unit was less than its carrying amount,

resulting in a series of impairment charges. The underlying

fair value assessment was initially triggered by an agreement

in September 2014 to sell the China-based battery joint venture

and a related decision to pursue options to exit the remainder

of the atteries business. The results of our annual goodwill

impairment testing during fiscal 2014 had indicated a decline

in the fair value of the atteries reporting unit due to lower

long-term market growth assumptions in certain key

geographies. At that time, the estimated fair value of the

atteries business continued to exceed its underlying carrying

value, but the fair value cushion had been reduced to about 5.

The agreement to sell the China-based battery joint venture

was at a transaction value that was below the earnings multiple

implied from the prior valuation of our atteries business,

which effectively eliminated our fair value cushion. As a result,

the remaining business unit cash flows no longer supported the

remaining carrying amount of the atteries business. Due

largely to these factors, we recorded an initial non-cash, before

and after-tax impairment charge of $863 million to reduce the

carrying amount of goodwill for the atteries business unit to

its estimated fair value. These same factors resulted in a decline

in the fair value of our Duracell trade name intangible asset

below its carrying value. This resulted in a non-cash, before-

tax impairment charge of $110 million ($69 million after tax)

to reduce the carrying amount of this asset to its estimated fair

value.

In November 2014, the Company reached an agreement to

divest the remaining atteries business via a split transaction

in which the Company will exchange a recapitalized Duracell

Company for erkshire Hathaway's (H) shares of P&G stock

(see Note 13). ased on the terms of the agreement and the

value of H's shares of P&G stock at the agreement date, and

changes thereto through June 30, 2015, the Company recorded

additional non-cash, before and after-tax impairment charges

totaling $1.2 billion. All of the fiscal 2015 impairment charges

in the atteries business are included as part of discontinued

operations.

The business unit valuations used to test goodwill and

intangible assets for impairment are dependent on a number of

significant estimates and assumptions, including

macroeconomic conditions, overall category growth rates,

competitive activities, cost containment and margin expansion

and Company business plans. e believe these estimates and

assumptions are reasonable. Changes to or a failure to achieve

these business plans or a further deterioration of the

macroeconomic conditions could result in a valuation that

would trigger an additional impairment of the goodwill and

intangible assets of these businesses. In addition, we also