Proctor and Gamble 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 52

Amounts in millions of dollars except per share amounts or as otherwise specified.

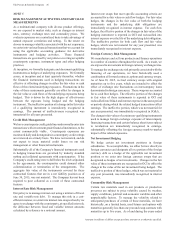

impairment assessment may be performed on the

recoverability of the carrying amounts.

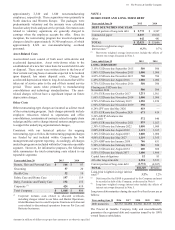

Goodwill and Other Intangile Assets

Goodwill and indefinite-lived intangible assets are not

amortized, but are evaluated for impairment annually or more

often if indicators of a potential impairment are present. Our

annual impairment testing of goodwill is performed separately

from our impairment testing of indefinite-lived intangible

assets.

e have acquired brands that have been determined to have

indefinite lives. e evaluate a number of factors to determine

whether an indefinite life is appropriate, including the

competitive environment, market share, brand history, product

life cycles, operating plans and the macroeconomic

environment of the countries in which the brands are sold.

hen certain events or changes in operating conditions occur,

an impairment assessment is performed and indefinite-lived

assets may be adjusted to a determinable life.

The cost of intangible assets with determinable useful lives is

amortized to reflect the pattern of economic benefits

consumed, either on a straight-line or accelerated basis over

the estimated periods benefited. Patents, technology and other

intangible assets with contractual terms are generally

amortized over their respective legal or contractual lives.

Customer relationships, brands and other non-contractual

intangible assets with determinable lives are amortized over

periods generally ranging from 5 to 30 years. hen certain

events or changes in operating conditions occur, an impairment

assessment is performed and remaining lives of intangible

assets with determinable lives may be adjusted.

For additional details on goodwill and intangible assets see

Note 2.

Fair Values of Financial Instruments

Certain financial instruments are required to be recorded at fair

value. Changes in assumptions or estimation methods could

affect the fair value estimates however, we do not believe any

such changes would have a material impact on our financial

condition, results of operations or cash flows. Other financial

instruments, including cash equivalents, certain investments

and short-term debt, are recorded at cost, which approximates

fair value. The fair values of long-term debt and financial

instruments are disclosed in Note 5.

New Accounting Pronouncements and Policies

In May 2014, the FAS issued ASU 2014-09, Revenue from

Contracts with Customers (Topic 606). This guidance

outlines a single, comprehensive model for accounting for

revenue from contracts with customers. e will adopt the

standard no later than July 1, 2018. hile we are currently

assessing the impact of the new standard, we do not expect this

new guidance to have a material impact on our Consolidated

Financial Statements.

No other new accounting pronouncement issued or effective

during the fiscal year had or is expected to have a material

impact on the Consolidated Financial Statements.

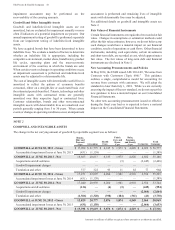

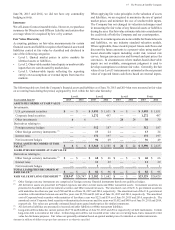

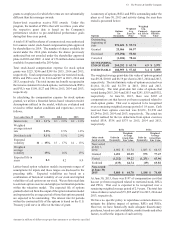

GOODWILL AND INTANGIBLE ASSETS

The change in the net carrying amount of goodwill by reportable segment was as follows:

Beaut,

Hair and

Personal

Care Grooming

Health

Care

Faric

Care and

Home

Care

Ba,

Feminine

and Famil

Care Cororate

Total

Coman

GOODWILL at UNE 0, 201 - Gross $ 17,094 $ 21,775 $ 6,185 $ 1,973 $ 4,828 $ 4,922 $ 56,777

Accumulated impairment losses at June 30, 2013 (431) (1,158)

(1,589)

GOODWILL at UNE 0, 201 - Net 16,663 20,617 6,185 1,973 4,828 4,922 55,188

Acquisitions and divestitures (3)

(2,445)(2,448)

Goodwill impairment charges

Translation and other 377 322 95 11 82 77 964

GOODWILL at UNE 0, 2014 - Gross 17,471 22,097 6,280 1,981 4,910 2,554 55,293

Accumulated impairment losses at June 30, 2014 (431) (1,158)

(1,589)

GOODWILL at UNE 0, 2014 - Net 17,040 20,939 6,280 1,981 4,910 2,554 53,704

Acquisitions and divestitures 1

449594

Goodwill impairment charges

2,042,04

Translation and other 1,50 1,209104141,0

GOODWILL at UNE 0, 2015 - Gross 15,29 20, 5, 1,4 4,549 2,04 50,99

Accumulated impairment losses at June 30, 2015 41 1,15

2,04,5

GOODWILL at UNE 0, 2015 - Net 15,9 19,19 5, 1,4 4,549 4,1