Proctor and Gamble 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

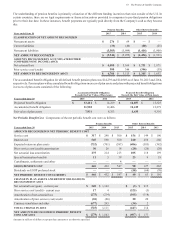

53 The Procter & Gamble Company

Amounts in millions of dollars except per share amounts or as otherwise specified.

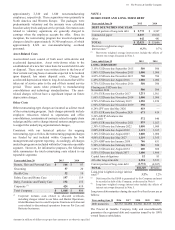

During 2015, we determined that the estimated fair value of

our atteries reporting unit was less than its carrying amount,

resulting in a series of impairment charges. The underlying

fair value assessment was initially triggered by an agreement

in September 2014 to sell the China-based battery joint venture

and a related decision to pursue options to exit the remainder

of the atteries business. The agreement to sell the China-

based battery joint venture was at a transaction value that was

below the earnings multiple implied from the prior valuation

of our atteries business, which effectively eliminated our fair

value cushion. As a result, the remaining business unit cash

flows no longer supported the remaining carrying amount of

the atteries business. Due largely to these factors, we recorded

an initial non-cash, before and after-tax impairment charge of

$863 to reduce the carrying amount of goodwill for the

atteries business unit to its estimated fair value. These same

factors resulted in a decline in the fair value of our Duracell

trade name intangible asset below its carrying value. This

resulted in a non-cash, before-tax impairment charge of $110

($69 after tax) to reduce the carrying amount of this asset to

its estimated fair value.

In November 2014, the Company reached an agreement to

divest the atteries business via a split transaction in which

the Company will exchange a recapitalized Duracell Company

for erkshire Hathaway's (H) shares of P&G stock (see Note

13). ased on the terms of the agreement and the value of H's

shares of P&G stock as of the transaction date and changes

thereto through June 30, 2015, the Company recorded

additional non-cash, before and after-tax impairment charges

totaling $1.2 billion. All of the fiscal 2015 impairment charges

in the atteries business are included as part of discontinued

operations. The atteries goodwill is included in Corporate in

the preceding table as of June 30, 2013 and 2014. The

remaining atteries goodwill at June 30, 2015 is reported in

Assets held for sale in the Consolidated alance Sheet. The

remaining change in goodwill during fiscal 2015 was primarily

due to currency translation across all reportable segments.

On July 31, 2014, the Company completed the divestiture of

its Pet Care operations in North America, Latin America and

other selected countries. In December 2014, the Company

completed the divestiture of its Pet Care operations in the other

markets, primarily the European union countries. The Pet Care

business was accounted for as a discontinued operation as of

June 30, 2014. As a result, the Pet Care goodwill is included

in Corporate in the preceding table as of June 30, 2013. Pet

Care goodwill and intangible assets at June 30, 2014 were

reported in Assets held for sale in accordance with the

accounting principles for discontinued operations. The

remaining change in goodwill during fiscal 2014 was primarily

due to currency translation across all reportable segments.

All of the goodwill and indefinite-lived intangible asset

impairment charges that are not reflected in discontinued

operations are included in Corporate for segment reporting.

The goodwill and intangible asset valuations are dependent on

a number of significant estimates and assumptions, including

macroeconomic conditions, overall category growth rates,

competitive activities, cost containment and margin expansion

and Company business plans. e believe these estimates and

assumptions are reasonable and are comparable to those that

would be used by other marketplace participants. However,

actual events and results could differ substantially from those

used in our valuations. To the extent such factors result in a

failure to achieve the level of projected cash flows used to

estimate fair value, we may need to record additional non-cash

impairment charges in the future. e also considered the

structure and value of the divestiture agreement with H in the

impairment testing for atteries. If the value of Hs shares

of the Company declines further before the transaction closing

date, we may need to record additional non-cash impairment

charges as part of discontinued operations in the future.

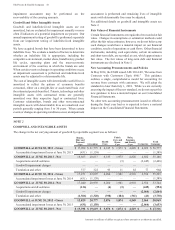

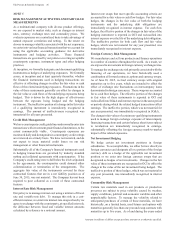

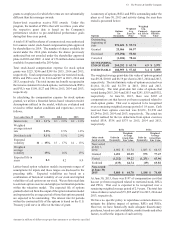

Identifiable intangible assets were comprised of:

2015 2014

Years ended

une 0

Gross

Carring

Amount

Accumulated

Amortiation

Gross

Carring

Amount

Accumulated

Amortiation

INTANGIBLE ASSETS WITH DETERMINABLE

LIVES

rands , 2,200 $ 4,154 $ (2,205)

Patents and

technology 2,2 2,0 2,850 (2,082)

Customer

relationships 1,21 59 2,002 (763)

Other 0 15 355 (164)

TOTAL ,2 5,051 $ 9,361 $ (5,214)

INTANGIBLE ASSETS WITH INDEFINITE LIVES

rands 2,4 26,696

TOTAL 1,0 5,051 $ 36,057 $ (5,214)

Due to the divestiture of the atteries and Pet Care businesses,

intangible assets specific to the atteries and Pet Care

businesses are reported in Assets held for sale in accordance

with the accounting principles for assets held for sale as of

June 30, 2015 and 2014.

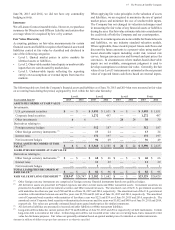

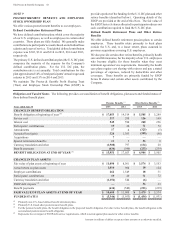

Amortization expense of intangible assets was as follows:

Years ended une 0 2015 2014 201

Intangible asset amortization 45 $ 514 $ 528

Estimated amortization expense over the next five fiscal years

is as follows:

Years ending une 0 201 201 201 2019 2020

Estimated

amortization expense $ 388 $ 350 $ 322 $ 299 $ 271

These estimates do not reflect the impact of future foreign

exchange rate changes.