Proctor and Gamble 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 72

Amounts in millions of dollars except per share amounts or as otherwise specified.

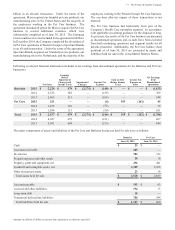

SUBSEUENT EVENT

On July 9, 2015, the Company announced the signing of a

definitive agreement to divest four product categories,

comprised of 43 of its beauty brands (eauty rands),

which will be merged with Coty, Inc. (Coty). hile the

ultimate form of the transaction has not yet been decided, the

Companys current preference is for a Reverse Morris Trust

split-off transaction in which P&G shareholders could elect

to participate in an exchange offer to exchange P&G shares

for Coty shares. The transaction includes the global salon

professional hair care and color, retail hair color, cosmetics

and fine fragrance businesses, along with select hair styling

brands. Combined, the eauty rands had $5.5 billion in net

sales for the year ended June 30, 2015. The Company expects

to close the transaction in the second half of calendar year

2016, pending regulatory approvals.

Cotys offer for the eauty rands, which was accepted by

the Company, was $12.5 billion. hile the final value of the

transaction will be determined at closing, based on Cotys

stock price and outstanding shares and equity grants as of the

date of signing, the value of the transaction was

approximately $15.0 billion. The value is comprised of

approximately 413 million shares, or 52 of the diluted

equity of the newly combined company, valued at

approximately $13.1 billion and the assumption of debt of

$1.9 billion by the entity holding the beauty businesses

immediately prior to close of the transaction. The assumed

debt is expected to vary between $3.9 billion and $1.9 billion,

depending on a $22.06 to $27.06 per share collar of Cotys

stock based on the trading price prior to the close of the

transaction, but will be subject to other contractual valuation

adjustments.

eginning in the quarter ending September 30, 2015, the

eauty rands will be reported as discontinued operations

in our Consolidated Financial Statements, with prior year

periods restated to reflect the same treatment.

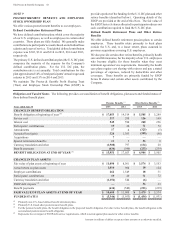

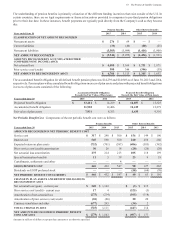

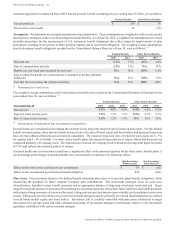

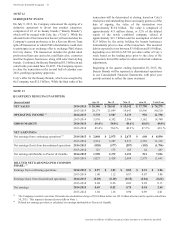

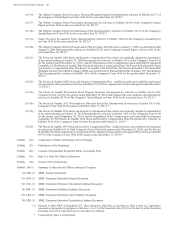

UARTERLY RESULTS UNAUDITED

uarters Ended Se 0 Dec 1 Mar 1 un 0 Total Year

NET SALES 2014-2015 20,1 20,11 1,142 1,90 ,29

2013-2014 20,174 21,099 19,641 19,596 80,510

OPERATING INCOME (1) 2014-2015 , ,94 ,15 90 11,90

2013-2014 3,970 4,302 3,306 3,162 14,740

GROSS MARGIN 2014-2015 49.4 50.0 4. 4.0 49.0

2013-2014 49.4 50.4 48.9 47.5 49.1

NET EARNINGS

Net earnings from continuing operations (1) 2014-2015 2,40 2,95 2,45 40 ,90

2013-2014 2,934 3,297 2,531 2,556 11,318

Net earnings(loss) from discontinued operations 2014-2015 20 5 2 102 1,

2013-2014 123 175 105 64 467

Net earnings attributable to Procter & Gamble 2014-2015 1,990 2,2 2,15 521 ,0

2013-2014 3,027 3,428 2,609 2,579 11,643

DILUTED NET EARNINGS PER COMMON

SHARE (2)

Earnings from continuing operations 2014-2015 0.9 1.02 0.5 0.22 .0

2013-2014 1.00 1.12 0.87 0.87 3.86

Earnings(loss) from discontinued operations 2014-2015 0.2 0.20 0.10 0.04 0.2

2013-2014 0.04 0.06 0.03 0.02 0.15

Net earnings 2014-2015 0.9 0.2 0.5 0.1 2.44

2013-2014 1.04 1.18 0.90 0.89 4.01

(1) The Company recorded a one-time enezuela deconsolidation charge of $2.0 billion before tax ($2.1 billion after tax) in the quarter-ended June

30, 2015. This impact is discussed more fully in Note 1.

(2) Diluted net earnings per share is calculated on earnings attributable to Procter & Gamble.