Porsche 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 Management Report

Group investment in property, plant and equipment

and intangible assets totaled 579.0 million Euro

compared to 407.4 million Euro in the previous year.

At our financial services entities, capital expenditures

on spending on leased assets amounted to 625.7

million Euro after 551.9 million Euro in the previous

year. Capital expenditures on property, plant and

equipment and intangible assets at Porsche AG

accounted for a figure of 608.1 million Euro (previous

year: 420.3 million Euro). This included various ratio-

nalization projects such as the ongoing modernization

of the IT systems, the replacement of existing assets,

and measures related to environmental protection.

A figure of 2.676 billion Euro was invested for the

step up of the equity investment in Volkswagen AG

to 30.6 percent.

Depreciation, amortization and write-downs in the

Group increased to 531.7 million Euro compared

to 488.8 million Euro the year before. The financial

services entities recorded depreciation, amortization

and write-downs of 182.9 million Euro (previous

year: 164.8 million Euro).

Mandatory Bid to Volkswagen Shareholders

After the end of the reporting year, Porsche spent a

further 7.5 million Euro in August 2007 to purchase

172,218 ordinary and 68,262 preference shares

of Volkswagen AG, which Porsche received from

Volkswagen shareholders in the course of the man-

datory bid. As required by the German legislator,

this mandatory bid became necessary after Porsche

exceeded the control threshold of 30 percent at Volks-

wagen on March 28, 2007. On April 30, Porsche

presented the bid, that had previously been cleared

for publication by the Federal Financial Supervisory

Authority (BaFin), to the Volkswagen shareholders.

The bid was limited to a period of four weeks and

ended on May 29, 2007. The Volkswagen share-

holders were offered 100.92 Euro per ordinary

share and 65.54 Euro per preference share which

corresponded to the legally prescribed minimum

price. As a result of the mandatory bid, Porsche

took over 0.06 percent of the VW ordinary shares

and voting rights and 0.06 percent of the VW pre-

ference shares and thus a share of 0.06 percent of

the share capital of Volkswagen AG.

Financial Structure: Cash Flow Increased

The extended cash flow – including changes to

other provisions – rose significantly in the course of

the reporting year. At 5.642 billion Euro, the figure

was significantly higher than that of the previous

year (2.101 billion Euro). Despite the purchase of

further shares in Volkswagen AG, net liquidity only

dropped to 283.2 million Euro (previous year:

1.881 billion Euro).

Due to the extremely high result, Group equity rose

by 4.143 billion Euro to 9.481 billion Euro.

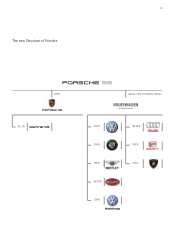

Decision in Favor of Porsche Automobil Holding SE

Towards the end of the fiscal year, on June 26, 2007,

the extraordinary stockholders' meeting decided

that Porsche would go into the future with a new

corporate structure and changed legal form. The

stockholders unanimously voted in favor of spinning

off the operating business of Porsche AG into a

wholly owned subsidiary in accordance with the pro-

visions of the reorganization law, to conclude a con-

trol and profit and loss transfer agreement between

the holding company and the operating subsidiary

and to convert the company acting as a holding

company in a European Stock Corporation, Societas

Europaea (SE). The stockholders also passed a

resolution to name the holding company Porsche

Automobil Holding SE. The registered offices of the

company are in Stuttgart. Dr. Ing. h.c. F. Porsche AG

continues to manage the operating subsidiary.

Subsequent Events

In August 2007, a further subsidiary was founded,

Porsche Switzerland. Headquartered in Zug, from

April 2008 the company is responsible for the import

and sale of Porsche vehicles, spare parts and ac-

cessories from AMAG Automobil- und Mortoren AG.

AMAG will remain a trading partner for Porsche.

The subsidiary will initially support a network of

twelve Porsche centers and 14 services operations.

04 ⁄ 05 05 ⁄ 06 06 ⁄ 07

1,332 2,101 5,642

919 959 1,205

Capital Expenditures* and Extended Cash Flow

in million Euro (Extended Cash Flow including changes to other provisions)

Capital Expenditures

Extended Cash Flow

* without financial investment

6,000

5,000

4,000

3,000

2,000

1,000