Porsche 2006 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147

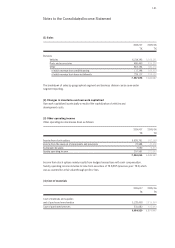

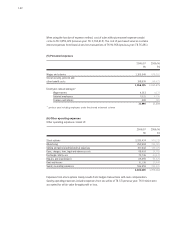

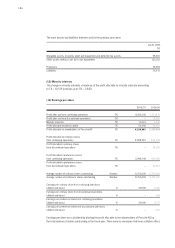

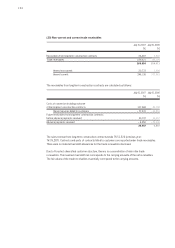

(14) Notes to the Consolidated Statement of Cash Flows

The cash and cash equivalents presented in the cash flow statement relates to the balance sheet item

cash and cash equivalents only, i.e. cash on hand, checks and bank balances with a maturity of less

than three months. The effects of exchange rate changes on cash and cash equivalents amount to

T€ – 6,184 (previous year: T€ 5,011) within the Group.

The cash flow statement shows how the cash and cash equivalents of the Porsche Group have changed

during the reporting year as a result of cash inflows and outflows. For this purpose the cash flows

are divided into operating activities, investing activities including investment in securities, and financing

activities in the cash flow statement.

Cash inflows and outflows from investing and financing activities are presented using the direct method.

The cash inflows and outflows from investing activities in the current fiscal year include additions to

property, plant and equipment and financial assets as well as additions to intangible assets. Changes in

leased assets and changes in receivables from financial services are also disclosed here. The cash

inflows and outflows from investing activities including investment in securities supplement the investing

activities in the current fiscal year by changes in investment in securities. Financing activities include

cash paid for dividend payments as well as the repayment of bonds and the pay-out of stock option trans-

actions and cash received from borrowing and amounts paid for stock option transactions.

The cash flow from operating activities, on the other hand, is derived indirectly from the profit after

tax. This involves eliminating all non-cash expenses - mainly depreciation or amortization and changes

in provisions – as well as non-cash income from profit after tax and adding changes in operating assets

and liabilities.

The changes in the balance sheet items from which the cash flow statement is derived are adjusted for

non-cash effects. Changes in the balance sheet items concerned can therefore not be reconciled directly

with the figures in the published consolidated balance sheet.

Other non-cash expenses/income mainly result from measuring stock options at fair value and the roll

forward of the shares accounted for at equity.

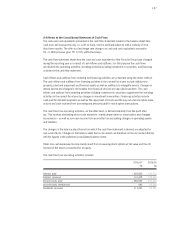

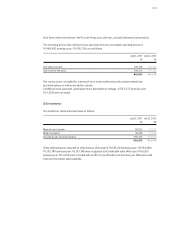

2006/07 2005/06

T€ T€

Interest paid – 338,826 – 140,133

Interest received 110,478 138,258

Income taxes paid – 568,833 – 440,425

Income taxes reimbursed 685 25,596

Dividends received 111,093 68,281

The cash flow from operating activities includes: