Porsche 2006 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

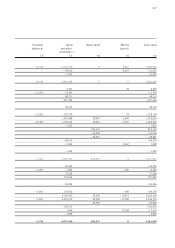

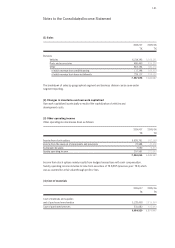

133

Years

Office and factory equipment 25 to 40

Technical equipment and machines 7 to 20

Other equipment, furniture and fixtures 3 to 13

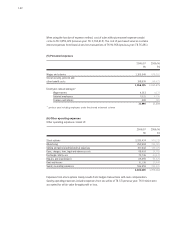

Residual values, methods of depreciation and useful lives are reviewed, and adjusted if appropriate, at

each fiscal year end. Self-constructed items of property, plant and equipment are recognized at cost. In

addition to directly allocable costs, they include a proportionate share of production-related overheads.

Leases

Determining whether an arrangement is or contains a lease is based on the substance of the arrangement

at inception date and whether the fulfillment of the arrangement is dependent on the use of a specific asset

or assets or the arrangement conveys a right to use the asset. This is only reassessed after the inception

of the lease under the conditions set forth in IFRIC 4 only.

Leases where the Group does not transfer substantially all the risks and rewards incidental to ownership of

the asset are classified as operating leases and recognized accordingly. Leases under which all the oppor-

tunities and risks associated with ownership are transferred, on the other hand, are classified as finance

leases and recognized accordingly.

Assets leased under operating leases are accounted for in non-current assets. Most of the operating

leases are for vehicles leased from the company’s own leasing companies. They are recognized at cost

and written off on a straight-line basis over the term of the lease to the lower of estimated residual value

or market value.

Borrowing cost

Borrowing cost is not disclosed as part of historical cost.

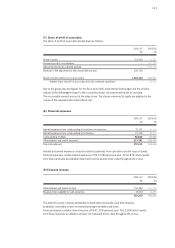

Impairment test

An impairment test is performed at least once a year for goodwill, but for other intangible assets with

finite useful lives as well as property, plant and equipment, leased assets and financial assets only when

there is an indication that the asset may be impaired. If the net realizable amount of the asset falls short of

the carrying amount, an impairment loss is recognized. The recoverable amount is generally estimated

separately per individual asset. If this is not possible, it is determined on the basis of a group of assets

which represent a cash generating unit. The recoverable amount is the higher of the fair value less cost

to sell. The fair value less cost to sell is the amount obtainable from the sale of an asset at customary

market conditions less the cost to sell. Value in use is determined using the discounted cash flow method

or capitalized earnings method on the basis of the estimated future cash flows expected to arise from

the continuing use and its disposal. The cash flows are derived from the long-term business planning and

current developments are taken into account. They are discounted to the balance sheet date using dis-

count rates for similar risks (before tax) of an average of 8.85 to 10 percent (as in the previous year).

If the reason for impairment losses recorded in previous years ceases to exist, the impairment loss is

reversed without exceeding amortized cost. This does not apply to goodwill.

Systematic depreciation is mostly based on the following useful lives: