Porsche 2006 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190

|

|

160

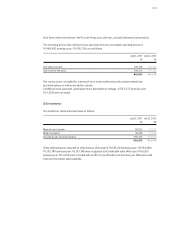

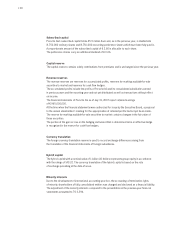

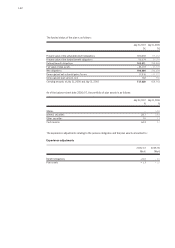

If the assumed healthcare cost increase rate increases or decreases by one percentage point,

the effects are as follows:

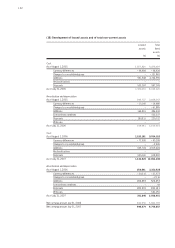

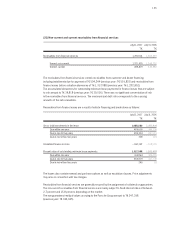

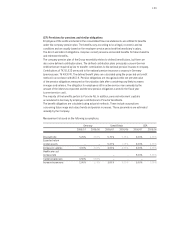

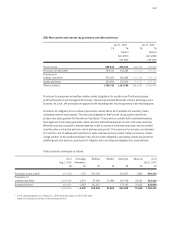

Amounts included in the income statement break down as follows:

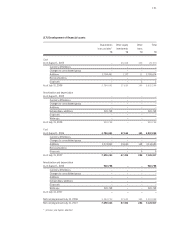

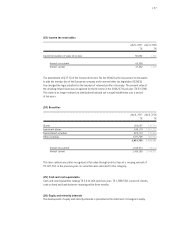

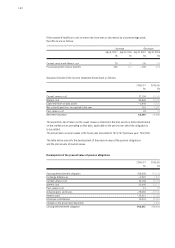

The expected rate of return on the asset classes contained in the plan assets is determined based

on the market prices prevailing on that date, applicable to the period over which the obligation is

to be settled.

The actual return on plan assets in the fiscal year amounted to T€ 3,747 (previous year: T€ 2,811).

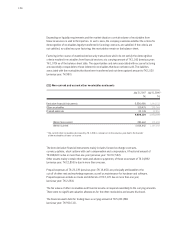

The table below presents the development of the present value of the pension obligations

and the plan assets at market values.

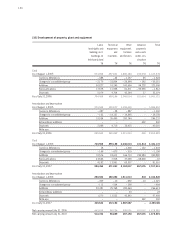

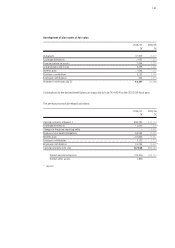

Development of the present value of pension obligations

2006/07 2005/06

T€ T€

Current service cost 32,194 39,143

Interest cost 33,660 30,172

Expected return on plan assets – 2,494 – 2,125

Net actuarial gain/loss recognized in the year 161 3,866

Past service cost 23 29

Net benefit expense 63,544 71,085

2006/07 2005/06

T€ T€

Opening defined benefit obligation 758,668 763,314

Exchange differences – 2,587 1,837

Current service cost 32,194 39,143

Interest cost 33,660 30,172

Past service cost 11 29

Actuarial gains and losses – 78,262 – 65,016

Benefits paid – 19,514 – 17,024

Employee contributions 19,501 13,055

Changes in the group reporting entity –– 6,842

Closing defined benefit obligation 743,671 758,668

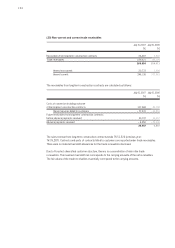

Increase Decrease

July31,2007 July31, 2006 July31,2007 July31,2006

T€ T€ T€ T€

Current service and interest cost 25 28 – 26 – 30

Post-employment medical benefits 336 313 – 309 – 298