Porsche 2006 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190

|

|

157

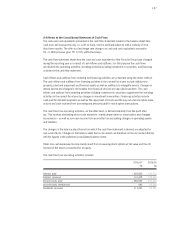

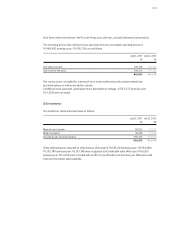

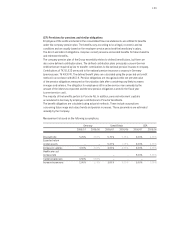

The amendment of §37 (5) of the Corporate Income Tax Act (KStG) by the law passed on measures

to aide the introduction of the European company and to amend other tax legislation (SEStEG)

has changed the legal situation for the taxation of retained profits in Germany. The present value of

the resulting refund claim was recognized for the first time in the 2006/07 fiscal year (T€ 63,598).

This claim is no longer realized via distributions but paid out in equal installments over a period

of ten years.

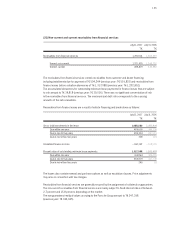

This item contains securities recognized at fair value through profit or loss at a carrying amount of

T€ 122,732. In the previous year, no securities were allocated to this category.

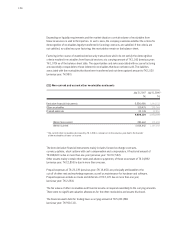

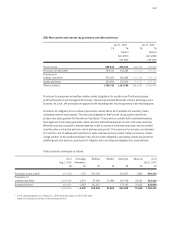

(23) Income tax receivables

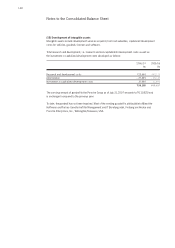

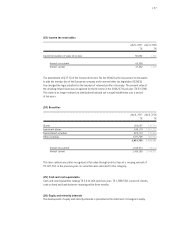

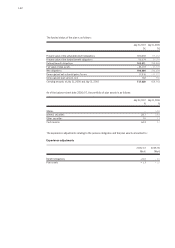

(25) Cash and cash equivalents

Cash and cash equivalents totaling T€ 2,410,066 (previous year: T€ 1,988,550) consist of checks,

cash on hand and bank balances maturing within three months.

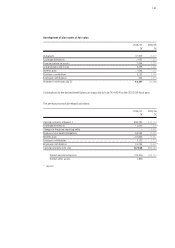

(26) Equity and minority interests

The development of equity and minority interests is presented in the statement of changes in equity.

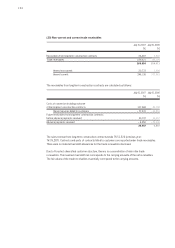

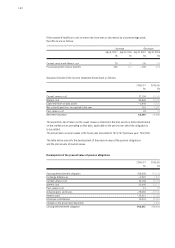

(24) Securities

July31,2007 July31,2006

T€ T€

Current receivables of taxes on income 90,860 1,306

thereof non-current 63,598 –

thereof current 27,262 1,306

July31,2007 July31, 2006

T€ T€

Shares 186,097 110,753

Investment shares 638,179 1,157,732

Fixed-interest securities 929,773 732,566

Other securities 679,709 760,542

2,433,758 2,761,593

thereof non-current 1,014,573 713,072

thereof current 1,419,185 2,048,521