Porsche 2006 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190

|

|

165

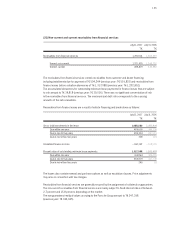

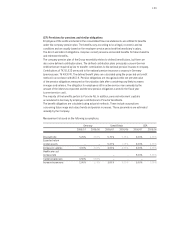

Liabilities to banks serve short-term financing purposes. The nominal interest rate varies from 0.75 percent

to 5.52 percent depending on the currency, maturity and contractual terms and conditions (previous year:

0.50 percent to 4.375 percent). They are recognized at amortized cost.

Other financial liabilities include liabilities for re-financing the financial services business which arose in

the context of non-recourse financing, sale-and-leaseback and asset-backed securities programs.

The present values of the future minimum lease payments from sale-and-lease-back transactions entered

into to refinance the financial services business break down as follows:

The total volume of asset-backed securities programs comes to T€ 1,849,048 as of the balance sheet

date (previous year: T€ 1,798,533). Interest rates correspond to interbank rates.

These financing programs have average maturities of between one and four years. They are measured

at amortized cost.

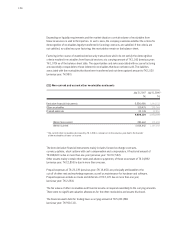

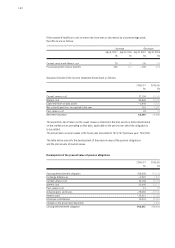

The liabilities from long-term construction contracts are calculated as follows:

The fair values of trade payables largely correspond to the carrying amounts.

July31,2007 July31, 2006

T€ T€

Minimum lease payments 76,429 75,427

Due within one year 42,970 39,519

Due in one to five years 33,459 35,908

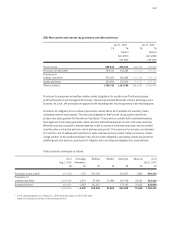

(30) Non-current and current trade payables

July31,2007 July31, 2006

T€ T€

Liabilities from long-term construction contracts 755 7,584

Trade payables 511,908 475,233

512,663 482,817

thereof non-current 7,480 3,875

thereof current 505,183 478,942

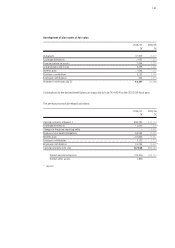

July 31,2007 July 31, 2006

T€ T€

Costs of conversion including outcome of

the long-term construction contracts 3,414 6,571

thereof services billed to customers – 2,091 – 1,402

Future receivables from long-term construction

contracts before advance payments received 1,323 5,169

Advance payments received – 2,078 – 12,753

755 7,584