Porsche 2006 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190

|

|

164

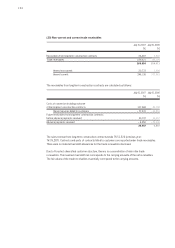

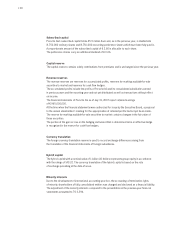

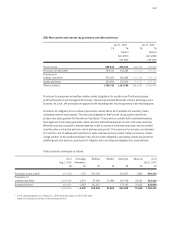

(29) Non-current and current financial liabilities

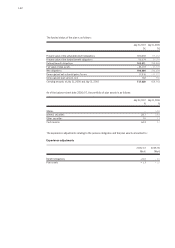

Financial liabilities break down as follows:

* Termination rights of minority interests result in additional current financial liabilities

of T€ 50,215 (previous year: T€ 49,845).

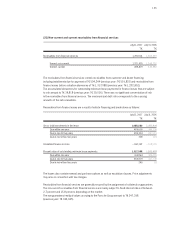

The two bonds issued in the fiscal year 2006 are fixed-interest bonds which are measured at amortized cost.

The other bonds are also fixed-interest instruments. They are recorded at fair value with an effect on

income. To hedge the risk of interest rate fluctuation, interest hedges were concluded which were also

recognized at fair value.

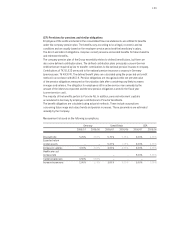

Due within Due within Due after

one year one to five years

five years

T€ T€ T€ T€

July 31, 2007

Bonds 2,322,252 – 1,137,784 1,184,468

Liabilities to banks 2,238,394 2,195,604 42,790 –

Other financial liabilities 1,988,615 814,420 1,174,195 –

6,549,261 3,010,024 2,354,769 1,184,468

July 31, 2006

Bonds 2,650,516 303,472 1,144,648 1,202,396

Liabilities to banks 218,986 184,742 34,244 –

Other financial liabilities 1,940,490 792,128 1,148,362 –

4,809,992 1,280,342 2,327,254 1,202,396

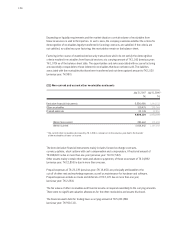

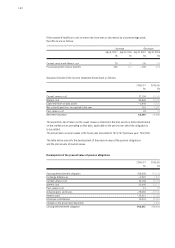

The following items are reported under bonds:

Issue Carrying Market Total Maturity Nominal Effective

volume amount value term interest rate interest rate

Currency in TLC in T€ in T€ % %

Bonds

Bond 2006 EUR 1,000,000 997,482 959,500 5 Jan. 11 3.500 3.580

Bond 2006 EUR 900,000 890,772 824,490 10 Jan. 16 3.875 4.020

Private placement 2004 USD 200,000 140,302 140,302 7 March 11 4.470 4.470

Private placement 2004 USD 150,000 104,025 104,025 10 March 14 4.980 4.980

Private placement 2004 USD 75,000 51,864 51,864 12 March 16 5.130 5.130

Private placement 2004 USD 200,000 137,807 137,807 15 March 19 5.330 5.330

*

*