Porsche 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.139

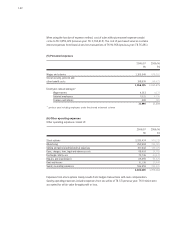

IFRIC 4 “Determining whether an Arrangement contains a Lease”

IFRIC 4 provides guidance in determining whether arrangements contain a lease to which lease accounting

must be applied.

IFRIC 5 “Rights to Interests arising from Decommissioning, Restoration and

Environmental Rehabilitation Funds”

IFRIC 5 governs the accounting treatment for funds set up to finance the decommissioning of an

entity’s assets.

IFRIC 6 “Liabilities arising from Participating in a Specific Market – Waste Electrical and

Electronic Equipment”

This interpretation regulates the recognition of a liability for the disposal of electrical and electronic

equipment in accordance with the provisions of the EU Directive relating to the disposal of Waste Electrical

and Electronic Equipment.

IFRIC 7 “Applying the Restatement Approach under IAS 29 Financial Reporting in Hyperinflationary

Economies”

IFRIC 7 stipulates that when hyperinflation is identified for the first time in the economy of the reporting

entity’s functional currency, the entity has to apply the provisions of IAS 29 as if it had always been a

hyperinflationary economy.

IFRIC 8 “Scope of IFRS 2”

IFRIC 8 requires IFRS 2 to be applied to any arrangements where equity instruments are issued for

consideration which appears to be less than fair value.

IFRIC 9 “Reassessment of Embedded Derivatives”

IFRIC 9 specifies how financial instruments with embedded derivatives should be accounted for

after initial recognition.

.

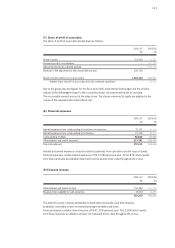

c) The following standards and interpretations which have been published but whose

adoption is not yet mandatory have not yet been adopted:

IFRS 7 “Financial Instruments: Disclosures”

IFRS 7 governs the disclosure requirements for financial instruments for industrial entities as well as

banks and similar financial institutions. IFRS 7 replaces IAS 30 “Disclosures in the Financial Statements

of Banks and Similar Financial Institutions” as well as the disclosure requirements contained in IAS 32

“Financial Instruments: Disclosure and Presentation”. IFRS 7 is applicable for fiscal years beginning on

or after January 1, 2007. The amendment will extend the disclosures on financial instruments required

in the notes.

IFRS 8 “Operating Segments”

IFRS 8 regulates the financial information which an entity has to present about its operating segments

in its reporting. IFRS 8 replaces IAS 14 “Segment Reporting”, applies the rulings SFAS 131 “Disclosures

about Segments of an Enterprise and related Information” with a few exceptions and has to be used

adopted for the first time in fiscal years beginning on or after January 1, 2009.

Amendment to IAS 1 “Presentation of Financial Statements”

These amendments result in new disclosures of internal control parameters and possibly also

explanations on the nature and scope of external capital requirements. The amendments of IAS 1

are mandatory for the first time for fiscal years beginning on or after January 1, 2007.