Porsche 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

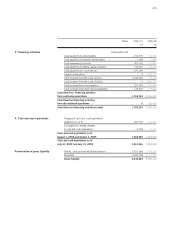

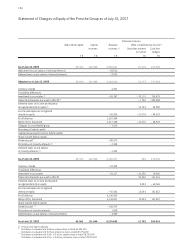

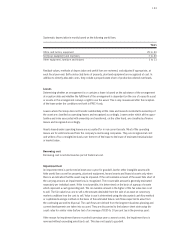

Revenue reserves

Subscribed capital Capital Revenue

Other comprehensive income

reserves reserves Securities marked Cash flow

to market hedges

T €T € T € T €T €

As of July 31, 2005 45,500 121,969 3,054,831 21,775 157,529

Adjustment for put options of minority interests – 43,913

Deferred taxes on put options of minority interests 13,625

Adjusted as of July 31, 2005 45,500 121,969 3,024,543 21,775 157,529

Currency change 4,321

Translation differences

Investment in associates 1) – 55,147 – 33,119 136,479

Financial instruments pursuant to IAS 39 1) – 1,750 – 205,584

Deferred taxes on income and expense

recognized directly in equity 1) 13,793 24,582

Income and expenses recognized

directly in equity – 50,826 – 21,076 – 44,523

Profit after tax 1,367,994

Net profit for the period 1,317,168 – 21,076 – 44,523

Changes to consolidated group – 1,815

Borrowing of hybrid capital

Capital procurement costs for hybrid capital

Share in profit hybrid capital

Dividends paid* – 86,975

Put options of minority interests 1) – 2,339

Deferred taxes on put options

of minority interests 1) – 1,945

As of July 31, 2006 45,500 121,969 4,248,637 699 113,006

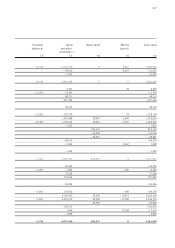

Currency change – 18,355

Translation differences

Investment in associates – 29,107 – 23,250 79,565

Financial instruments pursuant to IAS 39 26,260 131,316

Deferred taxes on income and expense

recognized directly in equity 9,083 – 69,069

Income and expenses recognized

directly in equity – 47,462 12,093 141,812

Profit after tax 4,196,963

Net profit for the period 4,149,501 12,093 141,812

Share in profit hybrid capital

Dividends paid ** – 156,975

Put options of minority interests 1,608

Deferred taxes on put options of minority interests – 3,089

As of July 31, 2007 45,500 121,969 8,239,682 12,792 254,818

126

Statement of Changes in Equity of the Porsche Group as of July 31, 2007

1) Previous year figures adjusted

*Distribution of a dividend of € 4.94 per ordinary share; in total € 43,225,000

Distribution of a dividend of € 5.00 per preference share; in total € 43,750,000

** Distribution of a dividend of € 5.94 + € 3.00 per ordinary share; in total € 78,225,000

Distribution of a dividend of € 6.00 + € 3.00 per preference share; in total € 78,750,000

1)

1)