Porsche 2006 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190

|

|

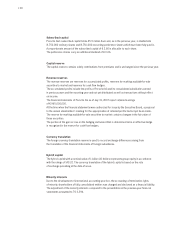

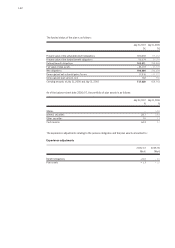

The carrying amounts and market values of the significant primary financial instruments are shown below:

July 31, 2007 July 31, 2006

Carrying Market Carrying Market

amount value amount value

T€ T€ T€ T€

Receivables from financial services 1,781,514 1,817,304 1,683,639 1,722,630

Financial liabilities 6,549,261 6,450,708 4,809,992 4,743,998

168

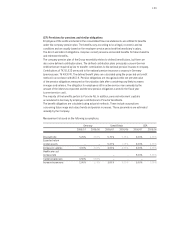

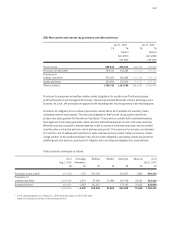

The market value of the financial derivatives is disclosed in the balance sheet under other receivables

and assets or other liabilities. The residual terms of the currency hedges for US dollar hedges is six years,

otherwise no more than four years.

The nominal volume and market value of derivative financial instruments are as follows:

July 31, 2007 July 31, 2006

Nominal Total market Nominal Total market

volume value volume value

T€ T€ T€ T€

Currency hedge 12,198,361 466,268 8,276,098 389,003

Interest hedge 1,091,319 34,998 1,292,744 34,692

Stock options 10,553,364 5,055,224 2,628,055 870,437

23,843,044 5,556,490 12,196,897 1,294,132

Currency hedge 1,357,879 13,866 1,441,224 9,572

Interest hedge 902,830 27,118 886,812 34,818

Stock options 13,473,485 2,445,118 2,441,025 980,716

15,734,194 2,486,102 4,769,061 1,025,106

Assets

Equity and

liabilities

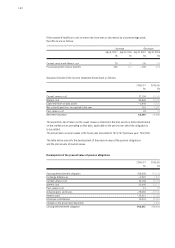

Measurement of financial instruments

The market value of financial instruments is determined by reference to stock market listings, reference

prices or generally accepted calculation models such as the discounted cash flow method.

The following term structure of interest rates was used were appropriate:

The market value of receivables from financial services is determined using the current market interest

rates as of the balance sheet date instead of the internal interest rate.

EUR USD GBP

Interest rate for 6 months 4.39% 5.33% 6.15%

Interest rate for 1 year 4.54% 5.25% 6.29%

Interest rate for 5 years 4.69% 5.31% 6.10%

Interest rate for 10 years 4.76% 5.53% 5.82%

Interest rate for 15 years 4.83% 5.67% 5.54%