Porsche 2006 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

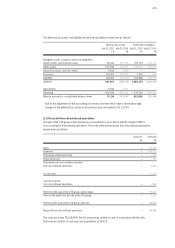

Fair value corresponds to market price provided the financial instruments measured are traded on an

active market. If there is no active market for a financial instrument, fair value is calculated using

appropriate actuarial methods such as recognized option price models or discounting future cash flows

with the market interest rate.

Amortized cost corresponds to costs of purchase less redemption, impairment losses and the reversal

of any difference between costs of purchase and the amount repayable upon maturity.

Financial instruments are recognized as soon as Porsche becomes a party to the financial instrument.

They are generally derecognized when the contract right to cash flow expires or this right is transferred

to a third party.

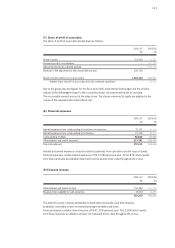

Primary financial instruments

Financial instruments which are recognized at fair value contain securities in the held-for-trading

category and financial assets which are initially recognized as financial assets at fair value through profit

or loss. Gains and losses from subsequent measurement are recognized in the net profit or loss. Financial

instruments that classified upon initial recognition at fair value through profit or loss include embedded

securities, index and discount certificates.

Financial instruments which are held to maturity are accounted for at cost.

Gains and losses from subsequent measurement are recognized in the net profit or loss.

Financial instruments categorized as available for sale are measured at fair value.

Unrealized gains and losses from subsequent measurement are recognized in equity after considering

deferred taxes until the investment is disposed of or an objective impairment occurs.

Equity investments which are disclosed in financial assets and not measured at equity also represent

available-for-sale financial instruments and are measured at fair value. If no active market is available and fair

value cannot reasonably be expected to be determined, they are measured at cost.

Financial assets are tested for impairment if there is an indication that the value of the asset may be

permanently impaired. An impairment loss is immediately recorded as an expense. Any loss previously

recorded in equity for available-for-sale investments is then also posted to the income statement.

Any increase in value at a later date is accounted for debt instruments by reversal of the impairment

loss with an effect on income.

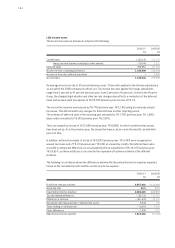

Loans issued and receivables, held-to-maturity investments and financial liabilities

are measured at amortized cost unless they are associated with hedging instruments. In particular,

these include trade receivables and payables, receivables from financial services, other receivables and

assets, held-to-maturity investments, financial liabilities and other liabilities. The liabilities which constitute

financial instruments within the meaning of IAS 39 are disclosed at fair value or amortized cost. Bonds

which were not issued in fiscal year 2005/06 and financial liabilities which are associated with fair value

hedge accounting are accounted for at fair value; all other liabilities as defined by IAS 39 are carried at

amortized cost. The liabilities from finance leases which are also disclosed under financial liabilities are

recognized at present value in accordance with IAS 17.