Porsche 2006 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.167

Notes on the other disclosures

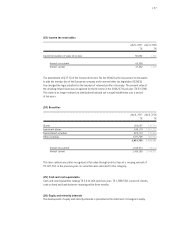

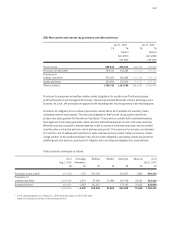

(32) Financial instruments

Hedging strategy

Owing to the international activities in the vehicles and financial services segment, changes in interest rates

and exchange rates affect the net assets, financial position and results of operations of the Porsche Group.

The risks result from foreign currency transactions in the course of ordinary operations, from financing and

from investing activities. It is the objective of the Group’s central treasury department to manage and thus

minimize these financial risks for the continued existence and earnings power by concluding hedges for the

Group. Guidelines are issued to govern discretionary decisions and internal controls and avoid a concentra-

tion of risk. The nature and volume of hedging transactions is generally chosen with regard to the underlying

contract. Hedging transactions may only be concluded to hedge existing underlyings or forecast trans-

actions. Only approved financial instruments may be entered into with approved counterparties.

Currency risk

Currency risks from current receivables, liabilities and debts as well as from highly likely future transactions

are generally hedged with forward exchange contracts, currency options or combined options.

Hedges for value fluctuations in future cash flows from anticipated highly likely transactions mainly relate

to planned sales in foreign currency. As of July 31, 2007, currency hedges are in place in particular for

the major currencies US dollar, pound sterling and Japanese yen.

Interest rate risk

The Porsche Group has issued fixed-interest bonds. The interest rate risks arising in this regard are largely

hedged by appropriate derivatives.

Stock options

Hedges have been entered into to secure the step-up of the shareholding in Volkswagen AG in the reporting

year and in preparation for the takeover bid for all Volkswagen AG shares. They are stock options with cash

compensation. In addition, stock options with various base values are used to obtain liquidity.

Bad debt exposure

The credit risk of financial assets is taken into account through adequate valuation allowances considering

existing collateral. Various hedging measures are taken to reduce the credit risk for primary financial

instruments, such as requesting collateral or guarantees and credit ratings based on information from

credit rating agencies and historical data.

Hedging transactions are only entered into with first-rate banks on the basis of uniform guidelines and are

monitored accordingly.