Porsche 2006 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138

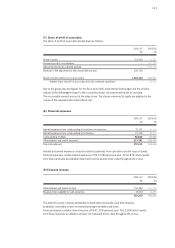

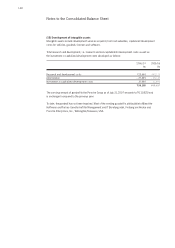

Contingent liabilities

A contingent liability is a possible obligation to third parties that arises from past events and whose

existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future

events not wholly within the control of the Porsche Group. A contingent liability may also be a present

obligation that arises from past events but is not recognized because an outflow of resources is not

probable or the amount of the obligation cannot be measured with sufficient reliability.

Discontinued operations pursuant to IFRS 5

Discontinued divisions which are removed from the consolidated group are disclosed separately in

accordance with IFRS 5, if material. Expenses and income arising previous to deconsolidation and the gain

on sale are disclosed separately in the income statement as assets allocated to discontinued operations.

The previous-year figures of the income statement are adjusted accordingly.

New Accounting Standards

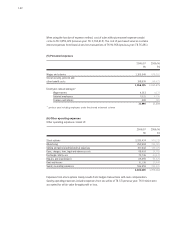

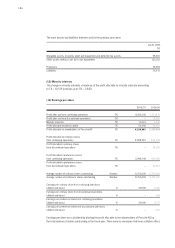

a) The Group has adopted the following new and amended IFRS and interpretations during

the fiscal year for the first time. Adoption of these interpretations had the following effect on

the consolidated financial statements:

Amendment to IAS 19: “Employee Benefits”

Due to the amendment to IAS 19, additional disclosures are made in the consolidated financial state-

ments containing information on the trends and experience adjustments in connection with the assets

and obligations from defined benefit plans and their composition. They are contained in Note 27.

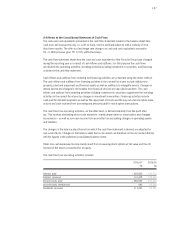

b) The following new or revised standards and interpretations which have been adopted

for first time had no or no material effect on the consolidated financial statements:

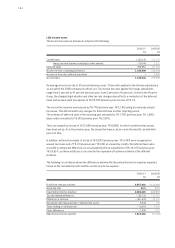

Change in IAS 39: “Fair Value Option”

The amended IAS 39 restricts the use of the option to designate any financial asset or any financial liability

to be measured at fair value through profit or loss.

Amendment to IAS 39: “Accounting of Hedges of Forecast Intragroup Transactions”

This amendment to IAS 39 permits the foreign currency risk of a highly probable forecast intragroup

transaction to qualify as the hedged item in a cash flow hedge in the consolidated financial statements,

provided that the transaction is denominated in a currency other than the functional currency of the entity

entering into that transaction and that the foreign currency risk will affect the consolidated income

statement.

Amendments to IAS 39: “Accounting for Financial Guarantee Contracts”

Financial guarantee contracts that are not considered to be insurance contracts are recognized initially

at fair value and remeasured at the higher of the amount determined in accordance with IAS 37 (Provisions,

Contingent Liabilities and Contingent Assets) and the amount initially recognized less, when appropriate,

cumulative amortization recognized in accordance with IAS 18 (Revenue).

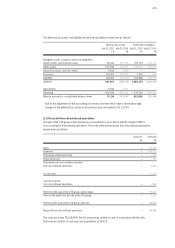

Amendment to IAS 21: “The Effects of Changes in Foreign Exchange Rates”

All exchange differences arising from a monetary item that forms part of the Group’s net investment in

a foreign operation are recognized in a separate component of equity in the consolidated financial state-

ments. This applies regardless of the currency in which the monetary item is designated and whether

the net investment was granted by the parent or another group company.