Porsche 2006 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144

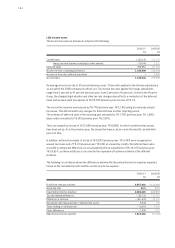

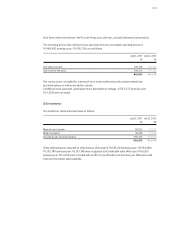

An average income tax rate of 30 percent (previous year: 39 percent) applies for the German subsidiaries

as a result of the 2008 company tax reform act. The income tax rates applied for foreign subsidiaries

range from 0 percent to 41 percent (previous year: from 0 percent to 41 percent). Overall in the Porsche

Group, the changed legal situation and other tax rate changes abroad led to a revaluation of the deferred

taxes and an associated tax expense of T€ 25,932 (previous year: income of T€ 17).

The current tax expense was reduced by T€ 778 (previous year: T€ 2,196) owing to previously unused

tax losses. This did not lead to any changes for deferred taxes in either reporting period.

The write-ups of deferred taxes in the reporting year amounted to T€ 7,760 (previous year: T€ 1,690);

depreciation amounted to T€ 149 (previous year: T€ 2,893).

There are unused tax losses of T€ 15,685 (previous year: T€ 8,848), for which no deferred tax assets

have been set up. As in the previous year, the unused tax losses can be carried forward for an unlimited

period of time.

In addition, deferred tax assets of a total of T€ 5,820 (previous year: T€ 3,443) were recognized on

unused tax losses and of T€ 12 (previous year: T€ 244) on unused tax credits. No deferred taxes were

recorded on temporary differences in accumulated profits at subsidiaries of T€ 26,159 (previous year:

T€ 18,614), as these profits are to be used for the expansion of business activities at the different

locations.

The following reconciliation shows the differences between the theoretical income tax expense expected

based on the calculated tax rate and the current income tax expense:

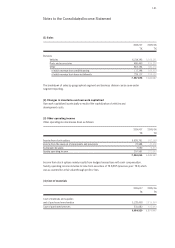

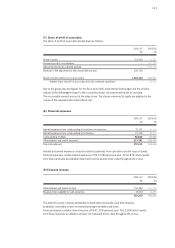

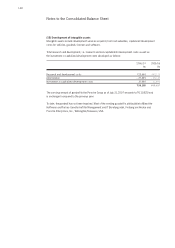

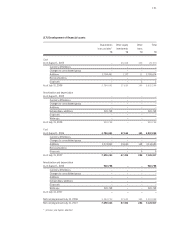

(10) Income taxes

The income tax expense disclosed comprises the following:

2006/07 2005/06

T€ T€

Current taxes 1,135,019 572,230

thereof income/expenses relating to other periods – 70,048 4,632

Deferred taxes 479,981 141,348

Income tax from continuing operations 1,615,000 713,578

Income tax from discontinued operations –3,422

Income taxes 1,615,000 717,000

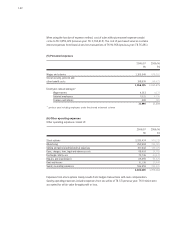

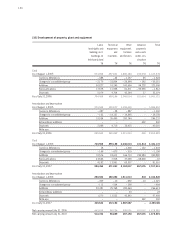

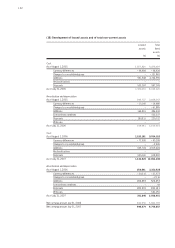

2006/07 2005/06

T€ T€

Profit from ordinary activities 5,857,000 2,110,000

Group tax rate 39 % 39 %

Expected income tax expense 2,284,230 822,900

Tax rate related differences – 135,132 – 30,381

Difference in tax base – 467,676 – 85,632

Recognition and measurement of deferred tax assets 5,938 768

Taxes relating to other periods – 70,454 9,896

Other differences – 1,906 – 551

Reported income tax expense 1,615,000 717,000