Porsche 2006 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2006 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Currency Translation

The financial statements of consolidated subsidiaries prepared in foreign currency are translated to the

Euro in accordance with IAS 21. The functional currency is the local currency for all consolidated entities,

since these subsidiaries are independent operations from a financial, economic and organizational

perspective. Assets, liabilities and contingent liabilities are translated at the mean rate as of the balance

sheet date, while equity is translated at historical rates with the exception of income and expenses

recorded directly in equity. The income statement is translated using average annual exchange rates.

Exchange rate differences resulting from the translation of financial statements are recognized as a

separate item directly under equity until the disposal of the subsidiary.

Foreign currency items in the financial statements of the entities included in consolidation are measured

at the historical rates. Monetary assets and liabilities denominated in foreign currencies are retranslated

at the functional currency rate of exchange ruling at the balance sheet date. Non-monetary items

denominated in a foreign currency measured at historical cost are translated using the exchange rate

at the date of the initial transaction. Non-monetary items measured at fair value in a foreign currency

are translated using the exchange rates at the date when the fair value was determined. Exchange rate

gains and losses as of the balance sheet date are recorded separately in the income statement.

Goodwill and adjustments of assets and liabilities from business combinations are recorded in the

functional currency of the subsidiary.

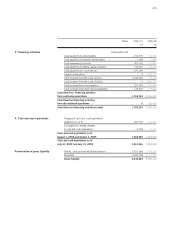

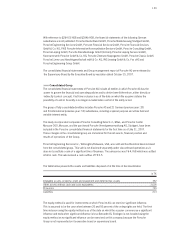

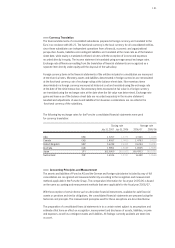

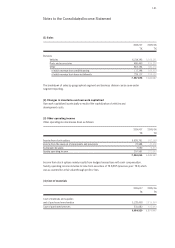

The following key exchange rates for the Porsche consolidated financial statements were used

for currency translation:

Closing rate Average rate

July 31, 2007 July 31, 2006 2006/07 2005/06

USA USD 1.3707 1.2772 1.3140 1.2226

Canada CAD 1.4587 1.4413 1.4793 1.4119

United Kingdom GBP 0.6749 0.6842 0.6744 0.6844

Australia AUD 1.5961 1.6689 1.6525 1.5566

Japan JPY 163.5900 146.0100 156.4703 140.8397

Switzerland CHF 1.6516 1.5701 1.6158 1.5566

Accounting Principles and Measurement

The assets and liabilities of Porsche AG and the German and foreign subsidiaries included by way of full

consolidation are recognized and measured uniformly according to the recognition and measurement

methods applicable in the Porsche Group. The comparative information for fiscal year 2005/06 is based

on the same accounting and measurement methods that were applicable for the fiscal year 2006/07.

With the exception of certain items such as derivative financial instruments, available-for-sale financial

assets or pensions and similar obligations, the consolidated financial statements are prepared using the

historical cost principle. The measurement principles used for these exceptions are described below.

The preparation of consolidated financial statements is to a certain extent subject to assumptions and

estimates that have an effect on recognition, measurement and disclosure of assets, liabilities, income

and expenses as well as contingent assets and liabilities. All findings currently available are taken into

account.