Panera Bread 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Preferred Stock

The Company is authorized to issue 2,000,000 shares of Class B preferred stock with a par value of $.0001. The

voting, redemption, dividend, liquidation rights, and other terms and conditions are determined by the Board of

Directors upon approval of issuance. There were no shares issued or outstanding in fiscal years 2008 and 2007.

Treasury Stock

Pursuant to the terms of the Panera Bread 1992 Stock Incentive Plan and the Panera Bread 2006 Stock

Incentive Plan and the applicable award agreements, the Company repurchased 20,378 shares of Class A common

stock at an average cost of $49.87 per share during fiscal 2008 and 6,594 shares of Class A common stock at an

average cost of $43.62 per share during fiscal 2007, as were surrendered by participants as payment of applicable

tax withholdings on the vesting of restricted stock. Shares so surrendered by the participants are repurchased by the

Company pursuant to the terms of those plans and the applicable award agreements and not pursuant to publicly

announced share repurchase programs. In fiscal 2000, the Company repurchased 109,000 shares of Class A

common stock at an average cost of $8.25 per share. The shares surrendered to the Company by participants during

fiscal 2008 and 2007 and repurchased by the Company in 2000 are currently held by the Company as treasury stock.

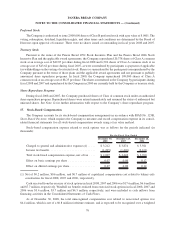

Share Repurchase Program

During fiscal 2008 and 2007, the Company purchased shares of Class A common stock under an authorized

share repurchase program. Repurchased shares were retired immediately and resumed the status of authorized but

unissued shares. See Note 12 for further information with respect to the Company’s share repurchase program.

17. Stock-Based Compensation

The Company accounts for its stock-based compensation arrangements in accordance with SFAS No. 123R,

Share-Based Payment, which requires the Company to measure and record compensation expense in its consol-

idated financial statements for all stock-based compensation awards using a fair value method.

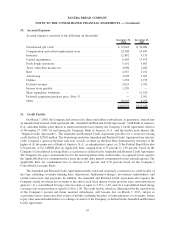

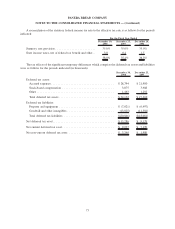

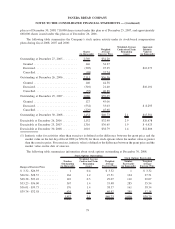

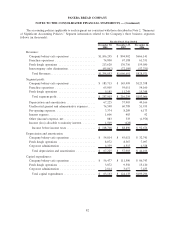

Stock-based compensation expense related to stock options was as follows for the periods indicated (in

thousands):

December 30,

2008

December 25,

2007

December 26,

2006

For the Fiscal Year Ended

Charged to general and administrative expenses(1) . .... $3,212 $ 3,874 $ 5,921

Income tax benefit............................. (1,205) (1,426) (2,161)

Total stock-based compensation expense, net of tax .... $2,007 $ 2,448 $ 3,760

Effect on basic earnings per share ................. 0.07 0.08 0.12

Effect on diluted earnings per share ................ 0.07 0.08 0.12

(1) Net of $0.2 million, $0.6 million, and $0.7 million of capitalized compensation cost related to bakery-cafe

construction for fiscal 2008, 2007 and 2006, respectively.

Cash received from the exercise of stock options in fiscal 2008, 2007 and 2006 was $17.6 million, $6.6 million

and $7.7 million, respectively. Windfall tax benefits realized from exercised stock options in fiscal 2008, 2007 and

2006 were $3.4 million, $3.7 million and $4.3 million, respectively, and were included as cash inflows from

financing activities in the Consolidated Statements of Cash Flows.

As of December 30, 2008, the total unrecognized compensation cost related to non-vested options was

$4.4 million, which is net of a $0.8 million forfeiture estimate, and is expected to be recognized over a weighted

76

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)