Panera Bread 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.aggregate amount of these investments. Subsequent to our fiscal 2008 year end and through February 27, 2009, the

date of our fiscal 2008 Form 10-K filing, we have received additional cash redemptions of $0.9 million at

approximately $0.830 per unit. We included $2.4 million of the remaining fair value of its Columbia Portfolio units

in short-term investments in the Consolidated Balance Sheets at December 30, 2008, as we reasonably believe the

cash redemptions will be received within the next twelve months based on the redemptions received to-date and

recent representations from the Columbia Portfolio management. However, the Columbia Portfolio has not made

any formal commitments on the availability or timing of future redemptions. The remaining $1.7 million of the fair

value of our Columbia Portfolio units have been classified as long-term investments in the Consolidated Balance

Sheets at December 30, 2008.

Regional factors could negatively impact our results of operations.

There are several states, particularly in the Midwest region of the United States, in which Panera, its

franchisees, or both own and operate a significant number of bakery-cafes. As a result, the economic conditions,

state and local laws, government regulations and weather conditions affecting those particular states, or a

geographic region generally, may have a material impact upon our results of operations.

Failure to meet market expectations for our financial performance will likely adversely affect the market

price of Panera stock.

The public trading of our stock is based in large part on market expectations that our business will continue to

grow and that we will achieve certain levels of financial performance. Should we fail to meet market expectations

going forward, particularly with respect to comparable bakery-cafe sales, net revenues, operating margins, and

earnings per share, the market price of our stock will likely decline.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

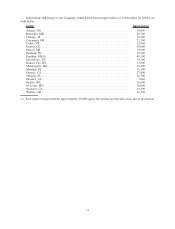

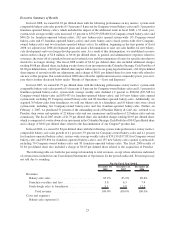

The average size of a Company-owned bakery-cafe is approximately 4,600 square feet for Panera and

3,500 square feet for Paradise. The square footage of each of our fresh dough facilities is provided below. We lease

all of our bakery-cafe locations and fresh dough facilities. Lease terms for our bakery-cafes and fresh dough

facilities are generally for 10 years with renewal options at most locations and generally require us to pay a

proportionate share of real estate taxes, insurance, common area, and other operating costs. Many bakery-cafe

leases provide for contingent rental (i.e. percentage rent) payments based on sales in excess of specified amounts.

Certain of our lease agreements provide for scheduled rent increases during the lease terms or for rental payments

commencing at a date other than the date of initial occupancy. See Note 2 to the consolidated financial statements

for further information on our accounting for leases.

16