Panera Bread 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Related Party Credit Agreement

In order to facilitate the Company’s opening of the first Panera Bread bakery-cafes in Canada, on September 10,

2008, the Company’s Canadian subsidiary, Panera Bread ULC, as lender, entered into a Cdn.$3.5 million secured

revolving credit facility agreement (“the Credit Agreement”) with Millennium Bread Inc., as borrower (“Millen-

nium”), and certain of its present and future subsidiaries, which have entered into franchise agreements with Panera

Bread ULC (“the Franchisee Guarantors”) to operate three Panera Bread bakery-cafes in Canada. Advances under the

Credit Agreement are subject to a number of pre-conditions, including a requirement that Millennium must have first

received and maintained a certain level of cash equity contributions or subordinated loans from Millennium’s

shareholders in relation to the amount of advances requested by Millennium under the Credit Agreement. The

borrowings under the Credit Agreement bear interest at the per annum rate of 7.58 percent, calculated daily and

payable monthly in arrears on the last business day of each fiscal month. The credit facility, which is collateralized by

present and future property and assets of Millennium and the Franchisee Guarantors, as well as the personal guarantees

of certain individuals, will become due on September 9, 2009, subject to acceleration upon certain specified events of

default, including breaches of representations or covenants, failure to pay other material indebtedness or a change of

control of Millennium, as defined in the Credit Agreement. The proceeds from the credit facility may be used by

Millennium to pay costs and expenses to develop and construct the Franchisee Guarantors’ bakery-cafes and for their

day-to-day operating requirements. As of December 30, 2008, there were no outstanding advances under the Credit

Agreement.

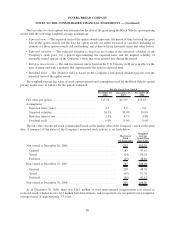

As part of the franchise agreement between Millennium and Panera Bread ULC, Panera Bread ULC will

develop and equip the bakery-cafe as a typical Panera Bread bakery-cafe in accordance with its then current design

and construction standards and specifications as applied by Panera to the bakery-cafe, in its sole discretion.

Millennium will pay the Company an amount equal to the total cost of development of the bakery-cafe, which

includes any and all costs and expenses incurred by Panera in connection with selection and development of the

bakery-cafe; however, no overhead expenses of Panera other than the development fee shall be included in total

cost. Panera will deliver possession of the bakery-cafe to Millennium when the bakery-cafe is substantially

complete, including issuance of a certificate of occupancy, and Millennium will open the bakery-cafe for business

with the public as soon as practicable following the date of delivery of possession of the bakery-cafe. On

September 15, 2008 and October 27, 2008, the Company delivered possession of the first two Panera Bread bakery-

cafes in Canada to Millennium, which subsequently opened on October 6, 2008 and November 10, 2008,

respectively. The Company delivered possession of the third bakery-cafe on December 16, 2008, which opened

on January 26, 2009 during the Company’s first quarter of fiscal 2009. As of December 30, 2008, the Company had

a $3.9 million receivable from Millennium included in other accounts receivable in its Consolidated Balance Sheets

representing the total cost of the bakery-cafes development. The Company expects settlement of this receivable to

be substantially funded by the use of the Credit Agreement previously described and cash payments.

Legal Proceedings

On January 25, 2008 and February 26, 2008, purported class action lawsuits were filed against the Company

and three of the Company’s current or former executive officers by the Western Washington Laborers-Employers

Pension Trust and by Sue Trachet, respectively, on behalf of investors who purchased the Company’s common stock

during the period between November 1, 2005 and July 26, 2006. Both lawsuits were filed in the United States

District Court for the Eastern District of Missouri, St. Louis Division. Each complaint alleges that the Company and

the other defendants violated Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”) and Rule 10b-5 under the Exchange Act in connection with the Company’s disclosure of system-

wide sales and earnings guidance during the period from November 1, 2005 through July 26, 2006. Each complaint

seeks, among other relief, class certification of the lawsuit, unspecified damages, costs and expenses, including

attorneys’ and experts’ fees, and such other relief as the court might find just and proper. On June 23, 2008, the

lawsuits were consolidated and the Western Washington Laborers-Employers Pension Trust was appointed lead

plaintiff in the lawsuit. On August 7, 2008, the plaintiffs filed an amended complaint, which extended the class

70

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)