Panera Bread 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

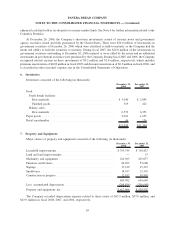

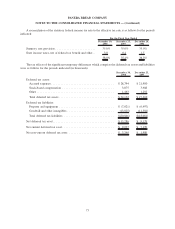

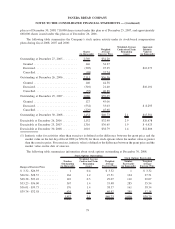

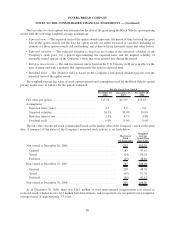

15. Deposits and Other

Deposits and other consisted of the following (in thousands):

December 30,

2008

December 25,

2007

Deferred income taxes ..................................... $3,349 $1,980

Deposits ............................................... 2,869 2,718

Deferred financing costs .................................... 1,125 206

Company-owned life insurance program ........................ 1,031 2,214

Note receivable .......................................... 589 599

Total deposits and other .................................... $8,963 $7,717

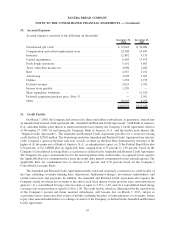

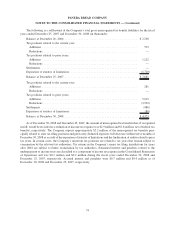

The Company established a company-owned life insurance (“COLI”) program covering a substantial portion

of its employees to help manage long-term employee benefit cost and to obtain tax deductions on interest payments

on insurance policy loans. However, due to tax law changes, the Company froze this program in 1998. Based on

current actuarial estimates, the program is expected to end in 2010.

At December 30, 2008 and December 25, 2007, the cash surrender values of $1.7 million and $2.7 million,

respectively, the mortality income receivables of $1.0 million and $2.2 million, respectively, and the insurance

policy loans of $1.7 million and $2.7 million, respectively, related to the COLI program were netted and included in

deposits and other assets in the Company’s Consolidated Balance Sheets. Mortality income receivable represents

the dividend or death benefits the Company is due from its insurance carrier at the respective dates. The insurance

policy loans are collateralized by the cash values of the underlying life insurance policies and require interest

payments at a rate of 9.08 percent for the year ended December 30, 2008. Interest accrued on insurance policy loans

is netted with other COLI related income statement transactions in other (income) expense, net in the Consolidated

Statements of Operations, which netted $0.1 million, $0.5 million, and $0.1 million in fiscal years 2008, 2007, and

2006, respectively.

16. Stockholders’ Equity

Common Stock

The holders of Class A common stock are entitled to one vote for each share owned. The holders of Class B

common stock are entitled to three votes for each share owned. Each share of Class B common stock has the same

dividend and liquidation rights as each share of Class A common stock. Each share of Class B common stock is

convertible, at the stockholder’s option, into Class A common stock on a one-for-one basis. At December 30, 2008,

the Company had reserved 3,502,851 shares of its Class A common stock for issuance upon exercise of awards

granted under the Company’s 1992 Equity Incentive Plan, Formula Stock Option Plan for Independent Directors,

2001 Employee, Director, and Consultant Stock Option Plan, and the 2006 Stock Incentive Plan, and upon

conversion of Class B common stock.

Registration Rights

At December 30, 2008, 93.8 percent of the Class B common stock is owned by the Company’s Chairman and

Chief Executive Officer (“CEO”). Certain holders of Class B common stock, including the Company’s CEO,

pursuant to stock subscription agreements, can require the Company under certain circumstances to register their

shares under the Securities Exchange Act of 1933, or have included in certain registrations all or part of such shares

at the Company’s expense.

75

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)