Panera Bread 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

our cash flow from operations and available borrowings under our existing credit facility will be sufficient to fund

our cash requirements for the foreseeable future.

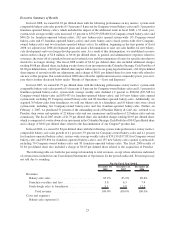

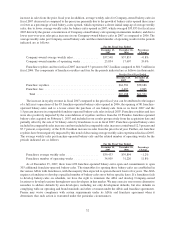

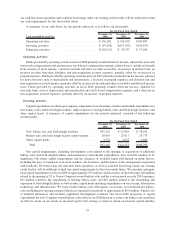

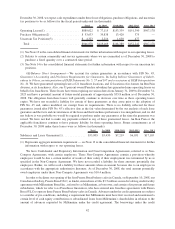

A summary of our cash flows, for the periods indicated, is as follows (in thousands):

Cash provided by (used in):

December 30,

2008

December 25,

2007

December 26,

2006

For the Fiscal Year Ended

Operating activities ............................ $156,282 $ 154,014 $104,895

Investing activities ............................. $ (47,663) $(197,262) $ (90,917)

Financing activities ............................ $(102,151) $ 59,393 $ 13,668

Operating Activities

Funds provided by operating activities in fiscal 2008 primarily resulted from net income, adjusted for non-cash

items such as depreciation and amortization, stock-based compensation expense, deferred taxes, and the tax benefit

from exercise of stock options, a decrease in trade and other accounts receivable, an increase in deferred rent, an

increase in other long-term liabilities and non-acquisition accrued expenses, partially offset by an increase in

prepaid expenses. Funds provided by operating activities in fiscal 2007 primarily resulted from net income, adjusted

for non-cash items such as depreciation and amortization, a decrease in prepaid expenses and deferred rent and

non-acquisition accrued expenses, partially offset by an increase in trade and other receivables and deferred income

taxes. Funds provided by operating activities in fiscal 2006 primarily resulted from net income, adjusted for

non-cash items such as depreciation and amortization and stock based compensation expense, and a decrease in

non-acquisition accrued expenses, partially offset by an increase in prepaid expenses.

Investing Activities

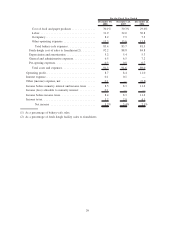

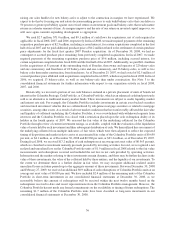

Capital expenditures are the largest ongoing component of our investing activities and include expenditures for

new bakery-cafes and fresh dough facilities, improvements to existing bakery-cafes and fresh dough facilities, and

other capital needs. A summary of capital expenditures for the periods indicated consisted of the following

(in thousands):

December 30,

2008

December 25,

2007

December 26,

2006

For the Fiscal Year Ended

New bakery-cafe and fresh dough facilities .......... $39,122 $ 92,864 $ 78,652

Bakery-cafe and fresh dough facility improvements .... 20,665 27,617 25,775

Other capital needs ............................ 3,376 3,652 4,869

Total ..................................... $63,163 $124,133 $109,296

Our capital requirements, including development costs related to the opening or acquisition of additional

bakery-cafes and fresh dough facilities and maintenance and remodel expenditures, have and will continue to be

significant. Our future capital requirements and the adequacy of available funds will depend on many factors,

including the pace of expansion, real estate markets, site locations, and the nature of the arrangements negotiated

with landlords. We believe that our cash flow from operations, as well as available borrowings under our existing

credit facility, will be sufficient to fund our capital requirements for the foreseeable future. We currently anticipate

total capital expenditures for fiscal 2009 of approximately $75 million, which consists of the following: $40 million

related to the opening of 32 to 36 new Company-owned bakery-cafes and the costs incurred on early 2010 openings;

$25 million related to the remodeling of existing bakery-cafes; and $10 million related to the remodeling and

expansion of fresh dough facilities as well as other capital needs including expenditures on our concept, information

technology, and infrastructure. We expect future bakery-cafes will require, on average, an investment per bakery-

cafe (excluding pre-opening expenses which are expensed as incurred) of approximately $0.9 million, which is net

of landlord allowances and excludes capitalized development overhead. Our fiscal 2009 projection of capital

expenditures for new Company-owned bakery-cafes reflects our 2008 decision to reduce our bakery-cafe growth in

an effort to focus on our return on invested capital. Our strategy to improve return on invested capital includes

35