Panera Bread 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset Retirement Obligations

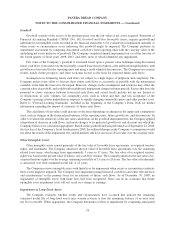

The Company recognizes the future cost to comply with lease obligations at the end of a lease as it relates to

tangible long-lived assets in accordance with the provisions of SFAS No. 143, Accounting for Asset Retirement

Obligations, as interpreted by FIN No. 47, Accounting for Conditional Asset Retirement Obligations. A liability for

the fair value of an asset retirement obligation along with a corresponding increase to the carrying value of the

related long-lived asset is recorded at the time a lease agreement is executed. The Company amortizes the amount

added to property and equipment and recognizes accretion expense in connection with the discounted liability over

the life of the respective lease. The estimated liability is based on experience in closing bakery-cafes and the related

external cost associated with these activities. Revisions to the liability could occur due to changes in estimated

retirement costs or changes in lease term.

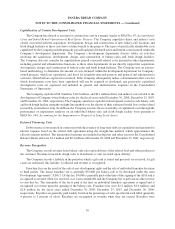

Variable Interest Entities

The Company applies the provisions of FIN No. 46R, Consolidation of Variable Interest Entities, an

Interpretation of ARB No. 51, revised in December 2003, to all franchise entities, which operate our franchise-

operate bakery-cafes, in which the Company holds an interest. In December 2008, the FASB issued FASB Staff

Position (“FSP”) SFAS No. 140-4 and FIN No. 46R-8, Disclosures by Public Entities (Enterprises) about Transfers

of Financial Assets and Interests in Variable Interest Entities, which is effective for the first reporting period ending

after December 15, 2008. This FSP requires additional disclosures related to variable interest entities (“VIE”) in

accordance with SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of

Liabilities, and FIN No. 46R. Generally a VIE is an entity with one or more of the following characteristics: (a) the

total equity investment at risk is not sufficient to permit the entity to finance its activities without additional

subordinated financial support; (b) as a group the holders of the equity investment at risk lack (i) the ability to make

decisions about an entity’s activities through voting or similar rights, (ii) the obligation to absorb the expected losses

of the entity; or (c) the equity investors have voting rights that are not proportional to their economic interests and

substantially all of the entity’s activities either involve, or are conducted on behalf of, an investor that has

disproportionately few voting rights. FIN No. 46R requires a VIE to be consolidated in the financial statements of

the entity that is determined to be the primary beneficiary of the VIE.

The Company’s determination of the primary beneficiary of each VIE requires judgment and is based on an

analysis of all relevant facts and circumstances including: (a) the existence of a principal-agency relationship

between the Company and the franchisee; (b) the relationship and significance of the activities of the VIE to the

Company and the franchisee; (c) the Company and the franchisee’s exposure to the expected losses of the VIE; and

(d) the design of the VIE. We do not posses any ownership interests in franchise entities. The franchise agreements

are designed to provide the franchisee with key decision-making ability to enable it to oversee its operations and to

have a significant impact on the success of the franchise, while the Company’s decision-making rights are related to

protecting its brand. Based upon its analysis of all the relevant facts and considerations of the franchise entities, the

Company has concluded that it is not the primary beneficiary of the entities and therefore, these entities have not

been consolidated.

Recently Issued Pronouncements

In December 2007, the FASB issued SFAS No. 141R, Business Combinations. SFAS No. 141R establishes

principles and requirements for how the acquirer of a business recognizes and measures in its financial statements

the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree. The

statement also provides guidance for recognizing and measuring the goodwill acquired in the business combination

and determines what information to disclose to enable users of the financial statement to evaluate the nature and

financial effects of the business combination. SFAS No. 141R is effective for financial statements issued for fiscal

years beginning after December 15, 2008. Accordingly, any business combinations the Company engages in will be

recorded and disclosed following the new standard beginning December 31, 2008. The Company expects

59

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)