Panera Bread 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

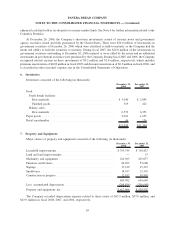

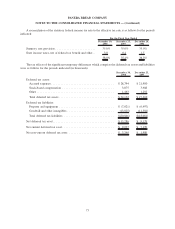

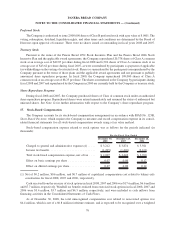

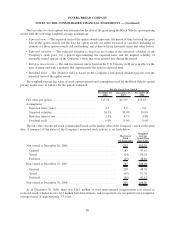

A reconciliation of the statutory federal income tax rate to the effective tax rate is as follows for the periods

indicated:

December 30,

2008

December 25,

2007

December 26,

2006

For the Fiscal Year Ended

Statutory rate provision ......................... 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit and other. . 3.0 0.4 1.5

38.0% 35.4% 36.5%

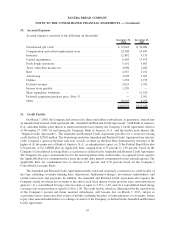

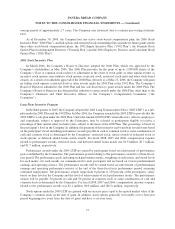

The tax effects of the significant temporary differences which comprise the deferred tax assets and liabilities

were as follows for the periods indicated (in thousands):

December 30,

2008

December 25,

2007

Deferred tax assets:

Accrued expenses ....................................... $28,794 $ 21,980

Stock-based compensation ................................ 3,875 3,988

Other ................................................ 1,463 1,292

Total deferred tax assets .................................. $34,132 $ 27,260

Deferred tax liabilities:

Property and equipment .................................. $ (7,021) $ (6,497)

Goodwill and other intangibles ............................. (13,825) (11,584)

Total deferred tax liabilities ............................... $(20,846) $(18,081)

Net deferred tax asset ...................................... $13,286 $ 9,179

Net current deferred tax asset ................................ $ 9,937 $ 7,199

Net non-current deferred tax asset............................. $ 3,349 $ 1,980

73

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)