Panera Bread 2008 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.April 13, 2009

Dear Stockholder,

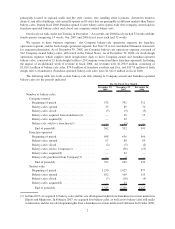

For many U.S. companies, 2008 was a year in which the economy collapsed and the stock market fell more

than 30 percent. For Panera though, 2008 was a great year — one of the strongest in our history. We’re proud to have

met or exceeded our earnings targets in each quarter of 2008. Our stock was up 50 percent in 2008, which made us

the best performing restaurant stock of 2008 and the second best performing stock in the Russell 1000 Index.

But we all know there are many one-year-wonders in our industry. I believe the real test of a company is its

ability to generate shareholder value over the long-term. Thus, I am pleased to be able to report that Panera has also

been the best performing stock in the restaurant industry (with a market capitalization of $200 million or greater)

when measured over the last decade (10 years ending December 31, 2008). In fact, in those 10 years, our stock has

appreciated at an annualized growth rate north of 30% — more than three times better than the next best performing

restaurant stock. It is also worth noting that we have been the tenth best performing stock in the entire Russell 1000

Index these past ten years.

So with this kind of track record, how do we go forward? How do we keep the momentum of the last decade

going into 2009 and well beyond?

The first thing we must acknowledge is that the Panera of today is not the Panera of a decade ago. Ten years

ago, we were a small Midwestern company growing at an exceptional rate relative to our size. Today, we are a

national brand with 1,325 company-owned and franchise-operated bakery-cafes and one of the largest food service

companies in the United States.

In my view, this size and scale represents as much risk as opportunity for a company like Panera. Why? Panera

grew and prospered because it represented a better alternative to its guests. It was “special” enough that consumers

went out of their way to visit Panera. Typically, size is the enemy of “special.” In fact, too often, in many companies

size is the forerunner to mediocrity. The reason for this is that size and scale are typically used simply to take cost

out of the value chain. Eventually, optimization and efficiency alone lead to a poorer guest experience, a lack of

“being special” and ultimately transaction falloff. And transaction falloff would be the long-term kiss of death for a

company like Panera.

Thus, in 2009 and beyond, we are committed to using our scale to further long-term concept differentiation. To

us that means not simply cost reduction, but sourcing and equipment development that allows us to do things for our

customer experience that no one else in our competitive set has been able to do to date. And to us that means

utilizing our scale to execute a more aggressive marketing strategy. We are not interested in marketing to simply

build name recognition and awareness. Rather, we will use our marketing to build deeper relationships with our

target customers. In sum, our intent is to use our size and scale to improve our competitive position.

I’d also like to comment on another issue that all companies are thinking about in 2009 — the recession.

Despite our success in 2008, we need to recognize that Panera faces the same pressures as every other company in

the country. Our experience in 2008 may indicate that Panera may be recession resistant, but it is not recession

proof. So, how does a growth company like Panera deal with the “economic collapse” and ensure we come out of the

recession with a stronger competitive position?

We must start by understanding our relative strength in this environment. We have strong and growing cash

flow and are anchored by a debt free balance sheet. Our comparable bakery-cafe sales continue to be among the best

in the industry. So the real question now becomes: how do we capitalize on these relative strengths to drive

competitive advantage during the most difficult economic climate of our professional lives?