Panera Bread 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.assets, $3.5 million to intangible assets, which represents the fair value of re-acquired territory rights and favorable

and unfavorable lease agreements, and $6.9 million to goodwill.

On September 27, 2006, the Company purchased from a franchisee substantially all of the assets of one

bakery-cafe for a cash purchase price of $2.4 million. Approximately $2.1 million of the acquisition price was paid

with cash on hand at the time of closing, while the remaining approximately $0.3 million plus accrued interest was

paid in fiscal 2007. The Consolidated Statements of Operations include the results of operations of the one

bakery-cafe from the date of acquisition. The pro forma impact of the acquisition on prior periods is not presented,

as the impact is not material to reported results. The Company allocated the purchase price to the tangible and

intangible assets acquired in the acquisition at their estimated fair values with the remainder allocated to tax

deductible goodwill as follows: $0.6 million to fixed assets, $0.1 million to intangible assets, which represents the

fair value of a re-acquired territory right and a favorable lease agreement, and $1.7 million to goodwill.

There were no business combinations consummated during the fiscal year ended December 30, 2008.

Subsequent to the original allocation of purchase price for the aforementioned acquisitions to the various tangible

and intangible assets, the Company had approximately $0.2 million of adjustments during fiscal 2008, which

resulted in a net $0.2 million increase to goodwill, and approximately $0.2 million of adjustments during fiscal

2007, which resulted in a net $0.2 million decrease to goodwill in the Consolidated Balance Sheets as a result of the

settlement of certain purchase price adjustments. Further, the pro forma impact of the acquisitions on prior periods

is not presented, as the impact of the series of individually immaterial business combinations completed during

fiscal 2007 are not material in the aggregate to reported results.

During the fiscal years ended December 30, 2008 and December 25, 2007, the Company paid approximately

$2.5 million and $9.6 million, including accrued interest, of previously accrued acquisition purchase price in

accordance with the asset purchase agreements, respectively. There was no accrued purchase price payments made

in the fiscal year ended December 26, 2006. There was no contingent or accrued purchase price remaining as of

December 30, 2008 while $2.5 million was outstanding as of December 25, 2007.

4. Fair Value Measurements

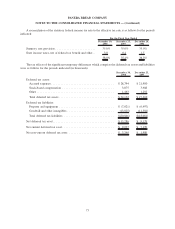

Effective December 26, 2007, the Company adopted SFAS No. 157, Fair Value Measures, for all financial

assets and liabilities and for nonfinancial assets and liabilities recognized or disclosed at fair value in the

consolidated financial statements on a recurring basis (at least annually). SFAS No. 157 defines fair value as

the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or

most advantageous market for the asset or liability in an orderly transaction between market participants on the

measurement date. The standard also establishes a fair value hierarchy which requires an entity to maximize the use

of observable inputs and minimize the use of unobservable inputs when measuring fair value. SFAS No. 157

describes three levels of inputs that may be used to measure fair value:

Level 1 Quoted market prices in active markets for identical assets or liabilities.

Level 2 Observable market based inputs or unobservable inputs that are corroborated by market data.

Level 3 Unobservable inputs that are not corroborated by market data.

The Company’s $76.6 million and $70.7 million in cash equivalents at December 30, 2008 and December 26,

2007, respectively, were carried at fair value in the Consolidated Balance Sheets based on quoted market prices for

identical securities (Level 1 inputs).

At December 30, 2008, the Company’s short-term and long-term investments were carried at fair value in the

Consolidated Balance Sheets and consisted of units of beneficial interest in the Columbia Strategic Cash Portfolio

(the “Columbia Portfolio”), which is an enhanced cash fund sold as an alternative to money-market funds. The

Company has historically invested a portion of its cash balances on hand in this fund; however, prior to the fourth

quarter of fiscal 2007, the amounts were approximately classified as trading securities in cash and cash equivalents

in the Consolidated Balance Sheets as the fund was considered both short-term and highly liquid in nature. The

63

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)