Panera Bread 2008 Annual Report Download - page 41

Download and view the complete annual report

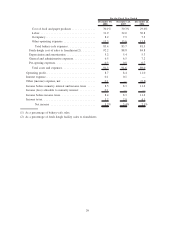

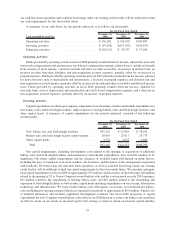

Please find page 41 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Income and Expense

Other income and expense in fiscal 2007 decreased to $0.3 million of expense, or less than 0.1 percent of total

revenue, from $2.0 million of income, or 0.2 percent of total revenue, in fiscal 2006. The decrease in other income

and expense for fiscal 2007 compared to fiscal 2006 was primarily from lower interest income in 2007 resulting

from lower cash and investments on-hand in 2007; a charge of approximately $0.2 million in the first quarter of

2007 stemming from the Paradise acquisition; a charge of approximately $1.1 million in the second quarter of 2007

relating to the termination of franchise agreements for certain acquired franchise-operated bakery-cafes that

operated at a royalty rate lower that the current market royalty rates; and a charge of approximately $1.0 million in

the fourth quarter of 2007 relating to an unrealized loss on our investment in the Columbia Strategic Cash Portfolio,

or the Columbia Portfolio, as a result of adverse market conditions that unfavorably affected the fair value and

liquidity of collateral underlying the Columbia Portfolio. Partially offsetting these items was a $0.5 million gain

from the sale of a bakery-cafe to a franchisee in the second quarter of 2007. See Note 3 to the consolidated financial

statements for further information with respect to the acquisition charges and gain on sale of the bakery-cafe and

Note 4 for further discussion regarding the Columbia Portfolio. Other income and expense in fiscal 2006 primarily

included interest income and $1.5 million of charges associated with the Paradise acquisition.

Income Taxes

The provision for income taxes decreased to $31.4 million in fiscal 2007 compared to $33.8 million in fiscal

2006. The tax provision for the 2007 and 2006 fiscal years reflected an effective tax rate of 35.4 percent and

36.5 percent, respectively. The tax provision in fiscal 2007 included $0.9 million of charges related to unfavorable

FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, or FIN No. 48, tax adjustments primarily

for certain state tax law changes; a $1.5 million tax benefit reflecting the expiration of the statute of limitations on

the recovery of certain previously deducted expenses; and a $0.8 million favorable provision to return adjustment to

fully recognize the benefit of deductions not previously recognized. Additionally, we adopted the provisions of

FIN No. 48 effective December 27, 2006. As a result of the implementation of FIN No. 48, we increased our existing

reserves for uncertain tax positions by $1.2 million in the first quarter of 2007, largely related to state income tax

matters. Of this amount, $0.4 million was recorded as deferred tax assets relating to the estimated federal tax

benefits and $0.8 million was recorded as a cumulative-effect adjustment to the beginning balance of retained

earnings. See Note 14 to the consolidated financial statements for further information with respect to the adoption of

FIN No. 48.

Liquidity and Capital Resources

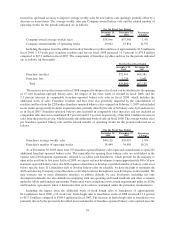

Cash and cash equivalents were $74.7 million at December 30, 2008 as compared with $68.2 million at

December 25, 2007. This increase is primarily a result of the $156.3 million of cash generated from operations, the

$17.6 million received from the exercise of employee stock options, and the $17.2 million received in investment

maturity proceeds during fiscal 2008, partially offset by the $75.0 million used to repay long-term debt, the

$63.2 million used for capital expenditures, and the $48.9 million used in share repurchases. Our primary source of

liquidity is cash provided by operations, although we have also borrowed under a credit facility principally to

finance repurchases of our common stock. Historically, our principal requirements for cash have primarily resulted

from our capital expenditures for the development of new Company-owned bakery-cafes, for maintaining or

remodeling existing Company-owned bakery-cafes, for purchasing existing franchise-operated bakery-cafes or

ownership interests in other restaurant or bakery-cafe concepts, for developing, maintaining or remodeling fresh

dough facilities, and for other capital needs such as enhancements to information systems and other infrastructure.

See Notes 11 and 12 to the consolidated financial statements for further information with respect to our credit

facility and our share repurchase program, respectively.

We had net working capital of $24.4 million at both December 30, 2008 and December 25, 2007. The

consistency in working capital from December 25, 2007 to December 30, 2008 resulted primarily from a decrease in

accrued expenses of $11.5 million, an increase in prepaid expenses of $9.0 million, an increase in cash and cash

equivalents of $6.5 million, and an increase in deferred taxes of $2.7 million, offset by a decrease in short-term

investments of $20.8 million and a decrease in trade and other accounts receivable of $11.7 million. We believe that

34