Panera Bread 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Although we believe we have adequately reserved for our uncertain tax positions, no assurance can be given

that the final tax outcome of these matters will not be different. We adjust these reserves in light of changing facts

and circumstances, such as the closing of a tax audit, the refinement of an estimate or changes in tax laws. To the

extent that the final tax outcome of these matters is different than the amounts recorded, such differences will impact

the provision for income taxes in the period in which such determination is made. The provision for income taxes

includes the impact of reserve provisions and changes to reserves that are considered appropriate, as well as the

related net interest.

The provision for income taxes is determined in accordance with the provisions of SFAS No. 109. Under this

method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences

between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis.

Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income

in the years in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax

assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Our effective tax rates have differed from the statutory tax rate primarily due to the impact of state taxes. Our

future effective tax rates could be adversely affected by changes in the valuation of our deferred tax assets or

liabilities, or changes in tax laws, regulations, accounting principles, or interpretations thereof. In addition, we are

subject to the continuous examination of our income tax returns by the Internal Revenue Service and other tax

authorities. We regularly assess the likelihood of adverse outcomes resulting from these examinations to determine

the adequacy of our provision for income taxes.

Lease Obligations

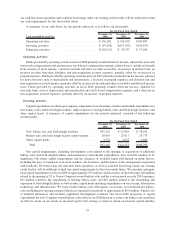

We lease all of our bakery-cafe and fresh dough facility properties. At the inception of the lease, each property

is evaluated to determine whether the lease will be accounted for as an operating or capital lease. The term used for

this evaluation includes renewal option periods only in instances in which the exercise of the renewal option can be

reasonably assured and failure to exercise such option would result in an economic penalty.

For leases that contain rent escalations, we record the total rent payable during the lease term, as determined

above, on a straight-line basis over the term of the lease, and record the difference between the minimum rent paid

and the straight-line rent as a lease obligation. Many of our leases contain provisions that require additional rental

payments based upon bakery-cafe sales volume (“contingent rent”). Contingent rent is accrued each period as the

liability is incurred, in addition to the straight-line rent expense noted above. This results in variability in occupancy

expense as a percentage of revenues over the term of the lease in bakery-cafes where we pay contingent rent.

In addition, we record landlord allowances for non-structural tenant improvements as deferred rent, which is

included in accrued expenses or deferred rent in the Consolidated Balance Sheets based on their short-term or long-

term nature. These landlord allowances are amortized over the reasonably assured lease term as a reduction of rent

expense. Also, leasehold improvements are amortized using the straight-line method over the shorter of their

estimated useful lives or the related reasonably assured lease term.

Management makes judgments regarding the probable term for each property lease, which can impact the

classification and accounting for a lease as capital or operating, the rent holiday and/or escalations in payments that

are taken into consideration when calculating straight-line rent and the term over which leasehold improvements for

each bakery-cafe and fresh dough facility is amortized. These judgments may produce materially different amounts

of depreciation, amortization and rent expense than would be reported if different assumed lease terms were used.

Stock-Based Compensation

We account for stock-based compensation in accordance with SFAS No. 123R, Share-Based Payment, which

requires us to measure and record compensation expense in our consolidated financial statements for all stock-based

compensation awards using a fair value method. We maintain several stock-based incentive plans under which we

may grant incentive stock options and non-statutory stock options for a fixed number of shares to certain directors,

officers, employees and consultants with an exercise price equal to the fair value of the shares at the date of grant.

We also may grant restricted stock and restricted stock units with fair value determined based on our closing stock

40