Panera Bread 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.price on the date of grant. In addition, we offer a stock purchase plan where employees may purchase our common

stock each calendar quarter through payroll deductions at 85 percent of market value on the purchase date and we

recognize compensation expense on the 15 percent discount.

For stock options, fair value is determined using the Black-Scholes option pricing model, which requires the

input of subjective assumptions. These assumptions include estimating the following:

•Expected term — The expected term of the option awards represents the period of time between the grant

date of the option awards and the date the option awards are either exercised or canceled, including an

estimate for those option awards still outstanding, and is derived from historical terms and other factors.

•Expected volatility — The expected volatility is based on an average of the historical volatility of our stock

price, for a period approximating the expected term, and the implied volatility of externally traded options of

our stock that were entered into during the period.

•Risk-free interest rate — The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the

time of grant and with a maturity that approximates the options expected term.

•Dividend yield — The dividend yield is based on our anticipated dividend payout over the expected term of

the option award.

Additionally, we use historical experience to estimate the expected forfeiture rate in determining the stock-

based compensation expense for these awards. Changes in these assumptions could produce significantly different

estimates of the fair value of stock-based compensation and consequently, the related amount of stock-based

compensation expense recognized in the Consolidated Statements of Operations. The fair value of the awards is

amortized over the vesting period. Options and restricted stock generally vest ratably over a four-year period

beginning two years from the date of grant and options generally have a six-year term.

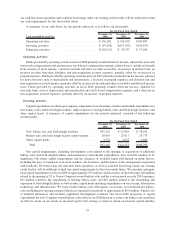

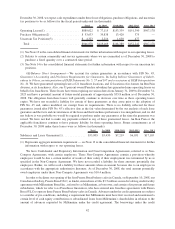

Contractual Obligations and Other Commitments

We currently anticipate total capital expenditures for fiscal 2009 of approximately $75 million, which consists

of the following: $40 million related to the opening of 32 to 36 new Company-owned bakery-cafes and the costs

incurred on early 2010 openings; $25 million related to the remodeling of existing bakery-cafes; and $10 million

related to the remodeling and expansion of fresh dough facilities as well as other capital needs including

expenditures on our concept, information technology, and infrastructure. We expect future bakery-cafes will

require, on average, an investment per bakery-cafe (excluding pre-opening expenses which are expensed as

incurred) of approximately $0.9 million, which is net of landlord allowances and excludes capitalized development

overhead. We expect to fund these expenditures principally through internally generated cash flow and available

borrowings under our existing credit facility.

In addition to our planned capital expenditure requirements, we have certain other contractual and committed

cash obligations. Our contractual cash obligations consist of noncancelable operating leases for our bakery-cafes,

fresh dough facilities and trucks and administrative offices; purchase obligations primarily for certain commodities;

and uncertain tax positions. Lease terms for our trucks are generally for six to eight years. Lease terms for our

bakery-cafes, fresh dough facilities, and administrative offices are generally for ten years with renewal options at

most locations and generally require us to pay a proportionate share of real estate taxes, insurance, common area,

and other operating costs. Many bakery-cafe leases provide for contingent rental (i.e. percentage rent) payments

based on sales in excess of specified amounts. Certain of our lease agreements provide for scheduled rent increases

during the lease terms or for rental payments commencing at a date other than the date of initial occupancy. As of

41