Panera Bread 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

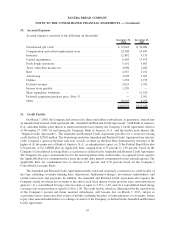

enhanced cash fund sold as an alternative to money-market funds. See Note 4 for further information related to the

Columbia Portfolio.

At December 26, 2006, the Company’s short-term investments consist of treasury notes and government

agency securities issued and fully guaranteed by the United States. There were $20.0 million of investments in

government securities at December 26, 2006 which were classified as held-to-maturity as the Company had the

intent and ability to hold the securities to maturity. During fiscal 2007, the $20.0 million of the investments in

government securities outstanding at December 26, 2006 matured or were called by the issuer and no additional

investments in government securities were purchased by the Company. During fiscal 2007 and 2006, the Company

recognized interest income on these investments of $0.2 million and $1.8 million, respectively, which includes

premium amortization of $0.03 million in fiscal 2007 and discount amortization of $0.3 million in fiscal 2006, and

is classified in other (income) expense, net in the Consolidated Statements of Operations.

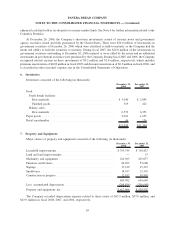

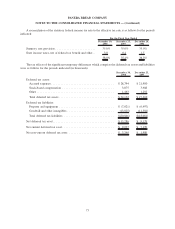

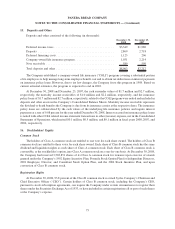

6. Inventories

Inventories consisted of the following (in thousands):

December 30,

2008

December 25,

2007

Food:

Fresh dough facilities:

Raw materials ........................................ $ 3,040 $ 2,849

Finished goods ....................................... 319 421

Bakery-cafes:

Raw materials ........................................ 6,533 6,353

Paper goods ............................................. 2,021 1,635

Retail merchandise ........................................ 46 136

$11,959 $11,394

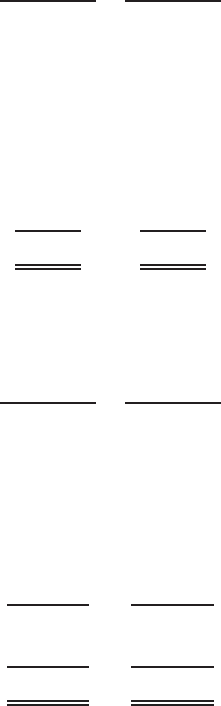

7. Property and Equipment

Major classes of property and equipment consisted of the following (in thousands):

December 30,

2008

December 25,

2007

Leasehold improvements ................................... $355,744 $ 318,427

Land and land improvements ................................ — 13

Machinery and equipment .................................. 221,963 205,077

Furniture and fixtures ...................................... 62,057 53,608

Signage ................................................ 17,129 15,319

Smallwares ............................................. 14,557 13,393

Construction in progress .................................... 12,452 30,803

683,902 636,640

Less: accumulated depreciation ............................... (266,896) (206,648)

Property and equipment, net ................................. $417,006 $ 429,992

The Company recorded depreciation expense related to these assets of $65.9 million, $57.0 million, and

$43.9 million in fiscal 2008, 2007, and 2006, respectively.

65

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)