Panera Bread 2008 Annual Report Download - page 63

Download and view the complete annual report

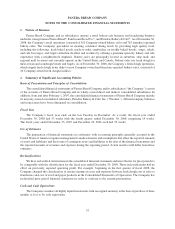

Please find page 63 of the 2008 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capitalization of Certain Development Costs

The Company has elected to account for construction costs in a manner similar to SFAS No. 67, Accounting for

Costs and Initial Rental Operations of Real Estate Projects. The Company capitalizes direct and indirect costs

clearly associated with the acquisition, development, design, and construction of new bakery-cafe locations and

fresh dough facilities as these costs have a future benefit to the projects. The types of specifically identifiable costs

capitalized by the Company include primarily payroll and payroll related taxes and benefit costs incurred within the

Company’s development department. The Company’s development department focuses solely on activities

involving the acquisition, development, design, and construction of bakery-cafes and fresh dough facilities.

The Company does not consider for capitalization payroll or payroll-related costs incurred in other departments,

including general and administrative functions, as these other departments do not directly support the acquisition,

development, design, and construction of bakery-cafes and fresh dough facilities. The Company uses an activity-

based methodology to determine the amount of costs incurred within the development department for Company-

owned projects, which are capitalized, and those for franchise-operated projects and general and administrative

activities, which both are expensed as incurred. If the Company subsequently makes a determination that a site for

which development costs have been capitalized will not be acquired or developed, any previously capitalized

development costs are expensed and included in general and administrative expenses in the Consolidated

Statements of Operations.

The Company capitalized $8.0 million, $10.2 million, and $9.1 million direct and indirect costs related to the

development of Company-owned bakery-cafes for the fiscal years ended December 30, 2008, December 25, 2007,

and December 26, 2006, respectively. The Company amortizes capitalized development costs for each bakery-cafe

and fresh dough facility using the straight-line method over the shorter of their estimated useful lives or the related

reasonably assured lease term. In addition, the Company assesses the recoverability of capitalized costs through the

performance of impairment analyses on an individual bakery-cafe and fresh dough facility basis pursuant to

SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets.

Deferred Financing Costs

Debt issuance costs incurred in connection with the issuance of long-term debt are capitalized and amortized to

interest expense based on the related debt agreement using the straight-line method, which approximates the

effective interest method. The unamortized amounts are included in deposits and other assets in the Consolidated

Balance Sheets and were $1.1 million and $0.2 million at December 30, 2008 and December 25, 2007, respectively.

Revenue Recognition

The Company records revenue from bakery-cafe sales upon delivery of the related food and other products to

the customer. Revenue from fresh dough sales to franchisees is also recorded upon delivery.

The Company records a liability in the period in which a gift card is issued and proceeds are received. As gift

cards are redeemed, this liability is reduced and revenue is recognized.

Franchise fees are the result of the sale of area development rights and the sale of individual franchise locations

to third parties. The initial franchise fee is generally $35,000 per bakery-cafe to be developed under the Area

Development Agreement (“ADA”). Of this fee, $5,000 is generally paid at the time of the signing of the ADA and is

recognized as revenue when it is received, as it is non-refundable and the Company has to perform no other service

to earn this fee. The remainder of the fee is paid at the time an individual franchise agreement is signed and is

recognized as revenue upon the opening of the bakery-cafe. Franchise fees were $2.2 million, $2.6 million, and

$2.8 million for the fiscal years ended December 30, 2008, December 25, 2007, and December 26, 2006,

respectively. Royalties are generally paid weekly based on the percentage of sales specified in each ADA (generally

4 percent to 5 percent of sales). Royalties are recognized as revenue when they are earned. Royalties were

56

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)