Nordstrom 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

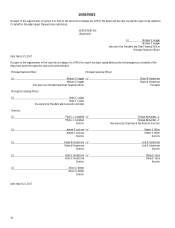

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

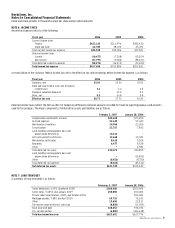

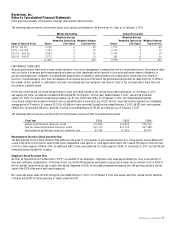

The following tables set forth the information for our reportable segments and a reconciliation to the consolidated totals:

Retail

Fiscal year 2006

Stores

Credit

Direct

Other

Eliminations

Total

Net sales (a)

$7,900,152

—

$555,504

$105,042

—

$8,560,698

Net sales increase

10.0%

N/A

23.0%

20.3%

N/A

10.8%

Intersegment revenues

—

$43,431

—

—

$(43,431)

—

Interest expense, net (b)

—

(26,770)

—

(15,988)

—

(42,758)

Other income (expense) including

finance charges, net

(11,412)

257,065

(798)

(6,330)

—

238,525

Depreciation and amortization

236,565

848

3,432

43,675

—

284,520

Earnings before income tax expense

1,185,401

60,396

140,348

(280,492)

—

1,105,653

Earnings before income tax expense

as a percentage of net sales

15.0%

N/A

25.3%

N/A

N/A

12.9%

Goodwill

8,462

—

15,716

27,536

—

51,714

Acquired tradename

—

—

—

84,000

—

84,000

Assets (c)

2,305,617

1,063,151

105,361

1,347,449

—

4,821,578

Capital expenditures

224,434

772

3,243

35,988

—

264,437

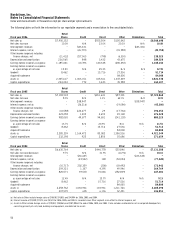

Retail

Fiscal year 2005

Stores

Credit

Direct

Other

Eliminations

Total

Net sales (a)

$7,183,918

—

$451,641

$87,301

—

$7,722,860

Net sales increase

8.3%

N/A

1.1%

62.1%

N/A

8.3%

Intersegment revenues

—

$38,947

—

—

$(38,947)

—

Interest expense, net (b)

—

(26,216)

—

(19,084)

—

(45,300)

Other income (expense) including

finance charges, net

(10,588)

224,677

29

(17,764)

—

196,354

Depreciation and amortization

223,258

1,209

2,693

49,168

—

276,328

Earnings before income tax expense

982,065

49,677

94,601

(241,118)

—

885,225

Earnings before income tax expense

as a percentage of net sales

13.7%

N/A

20.9%

N/A

N/A

11.5%

Goodwill

8,462

—

15,716

27,536

—

51,714

Acquired tradename

—

—

—

84,000

—

84,000

Assets (c)

2,285,259

1,164,472

85,082

1,386,536

—

4,921,349

Capital expenditures

232,198

925

2,850

35,686

—

271,659

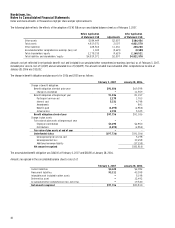

Retail

Fiscal year 2004

Stores

Credit

Direct

Other

Eliminations

Total

Net sales (a)

$6,630,764

—

$446,778

$53,846

—

$7,131,388

Net sales increase (decrease)

9.7%

N/A

31.9%

(16.9%)

N/A

10.6%

Intersegment revenues

—

$36,645

—

—

$(36,645)

—

Interest expense, net (b)

—

(23,522)

148

(54,054)

—

(77,428)

Other income (expense) including

finance charges, net

(10,717)

202,359

(208)

(18,492)

—

172,942

Depreciation and amortization

209,321

1,107

4,395

49,946

—

264,769

Earnings before income tax expense

820,571

39,503

70,046

(282,839)

—

647,281

Earnings before income tax expense

as a percentage of net sales

12.4%

N/A

15.7%

N/A

N/A

9.1%

Goodwill

8,462

—

15,716

27,536

—

51,714

Acquired tradename

—

—

—

84,000

—

84,000

Assets (c)

2,258,762

1,030,941

103,961

1,211,726

—

4,605,390

Capital expenditures

207,599

605

6,196

32,451

—

246,851

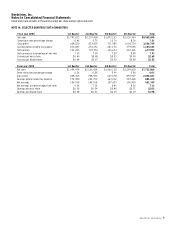

(a) Net sales in Other include foreign sales of $104,101, $93,851, and $94,994 for 2006, 2005, and 2004.

(b) Interest income of $13,309, $12,374, and $5,574 for 2006, 2005, and 2004 is recorded in our Other segment as an offset to interest expense, net.

(c) Assets in Other include foreign assets of $211,802, $204,865, and $207,095 at the end of 2006, 2005, and 2004. It also includes unallocated assets in corporate headquarters,

consisting primarily of cash, land, buildings and equipment, and deferred tax assets.