Nordstrom 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 39

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

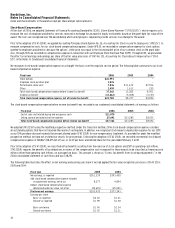

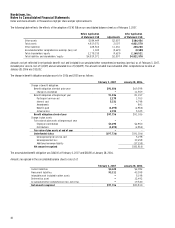

NOTE 2: ACCOUNTS RECEIVABLE

The components of accounts receivable are as follows:

February 3, 2007

January 28, 2006

Trade receivables:

Unrestricted

$43,793

$32,070

Restricted

582,281

552,671

Allowance for doubtful accounts

(17,475)

(17,926)

Trade receivables, net

608,599

566,815

Other

75,777

72,743

Accounts receivable, net

$684,376

$639,558

The restricted trade receivables relate to our Nordstrom private label card and back an unused variable funding note that is discussed in Note 7:

Long-term Debt. The unrestricted trade receivables consist primarily of our Façonnable wholesale receivables and accrued private label card finance

charges not yet allocated to customer accounts.

Other accounts receivable consist primarily of credit card receivables due from third-party financial institutions and vendor rebates, which are

believed to be fully realizable as they are collected soon after they are earned.

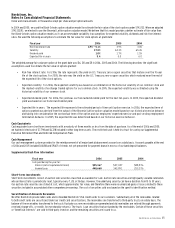

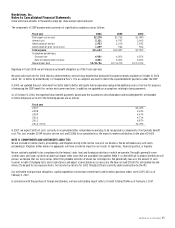

NOTE 3: INVESTMENT IN ASSET BACKED SECURITIES – CO-BRANDED NORDSTROM VISA CREDIT CARD RECEIVABLES

The following table presents the co-branded Nordstrom VISA credit card balances and the estimated fair values of our investment in asset

backed securities.

February 3, 2007

January 28, 2006

Total face value of co-branded Nordstrom VISA credit card

principal receivables

$907,983

$738,947

Securities issued by the VISA Trust:

Off-balance sheet (sold to third parties):

2002 Class A & B Notes

$200,000

$200,000

2004-2 Variable funding notes

350,000

—

$550,000

$200,000

Amounts recorded on balance sheet:

Investment in asset backed securities at fair value

$428,175

$561,136

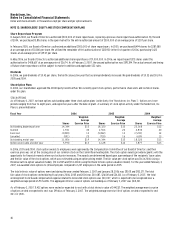

The following table presents the key assumptions we use to value the investment in asset backed securities:

February 3, 2007

January 28, 2006

Assumptions used to estimate the fair value of the

investment in asset backed securities:

Weighted average remaining life (in months)

7.5

7.6

Average annual credit losses

5.7%

4.7%

Average gross yield

16.8%

17.1%

Weighted average coupon on issued securities

5.3%

5.2%

Average monthly payment rates

8.0%

8.2%

Discount rate on investment in asset backed securities

7.3% to 11.5%

5.9% to 11.1%

The discount rate on asset backed securities represents the volatility and risk of the asset. Our discount rates consider both the current interest rate

environment and credit spreads.

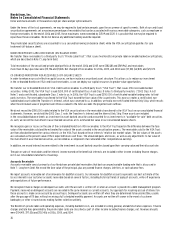

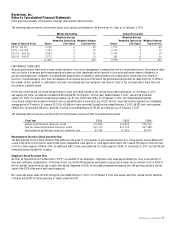

The following table illustrates the sensitivity of fair market value estimates of the investment in asset backed securities given independent

changes in assumptions as of February 3, 2007:

+10%

+20%

-10%

-20%

Gross yield

$8,558

$17,139

$(8,534)

$(17,045)

Interest expense on issued classes

(1,748)

(3,496)

1,748

3,496

Card holders’ payment rate

(239)

(689)

(130)

(894)

Charge offs

(2,970)

(5,904)

3,007

6,051

Discount rate

(1,850)

(3,681)

1,868

3,756