Nordstrom 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 37

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

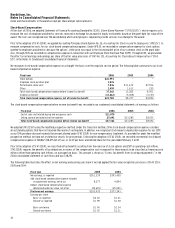

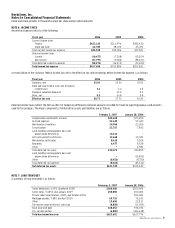

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market, using the retail method (first-in, first-out basis).

Land, Buildings and Equipment

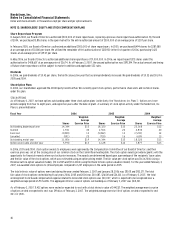

Depreciation is computed using the straight-line method. Estimated useful lives by major asset category are as follows:

Asset

Life (in years)

Buildings and improvements

5-40

Store fixtures and equipment

3-15

Leasehold improvements

Shorter of life of lease or asset life

Software

3-7

Intangible Asset Impairment Testing

We review our goodwill and acquired tradename annually for impairment in the first quarter or when circumstances indicate the carrying value

of these assets may not be recoverable. The goodwill and acquired tradename associated with our Façonnable business are our largest

impairment risks. The fair value of our intangible assets has exceeded their carrying value in each of the most recent three years.

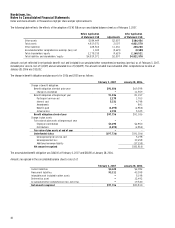

Leases

We recognize lease expense on a straight-line basis over the minimum lease term. In 2004, we corrected our lease accounting policy to recognize

lease expense, net of landlord reimbursements, from the time that we control the leased property. In the past, we recorded net rent expense once

lease payments or retail operations started. We recorded a charge of $7,753 ($4,729 net of tax) in the fourth quarter of 2004 to correct this

accounting policy. The impact of this change was immaterial to prior periods.

We lease the land or the land and building at many of our Full-Line stores, and we lease the building at many of our Rack stores. Additionally, we lease

office facilities, warehouses and equipment. Most of these leases are classified as operating leases and they expire at various dates through 2080.

We have no significant individual or master lease agreements.

Our fixed, noncancelable lease terms generally are 20 to 30 years for Full-Line stores and 10 to 15 years for Rack stores. Many of our leases include

options that allow us to extend the lease term beyond the initial commitment period, subject to terms agreed to at lease inception.

For leases that contain predetermined, fixed escalations of the minimum rent, we recognize the rent expense on a straight-line basis and record the

difference between the rent expense and the rent payable as a liability.

Most of our leases also provide for payment of operating expenses, such as common area charges, real estate taxes and other executory costs.

Some leases require additional payments based on sales and are recorded in rent expense when the contingent rent is probable.

Leasehold improvements made at the inception of the lease are amortized over the shorter of the asset life or the initial lease term as described

above. Leasehold improvements made during the lease term are also amortized over the shorter of the asset life or the remaining lease term.

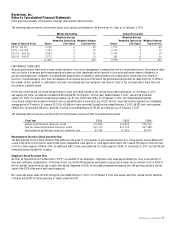

We receive incentives to construct stores in certain developments. These incentives are recorded as a deferred credit and recognized as a reduction

to rent expense on a straight-line basis over the lease term as described above. At the end of 2006 and 2005, this deferred credit balance was

$392,386 and $399,485. Also, we may receive incentives based on a store’s net sales; we recognize these incentives in the year that they are earned

as a reduction to rent expense.

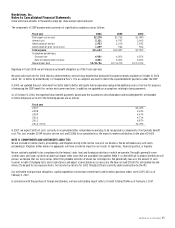

Foreign Currency Translation

The assets and liabilities of our foreign subsidiaries have been translated to U.S. dollars using the exchange rates effective on the balance sheet date,

while income and expense accounts are translated at the average rates in effect during the year. The resulting translation adjustments are recorded

in accumulated other comprehensive earnings.

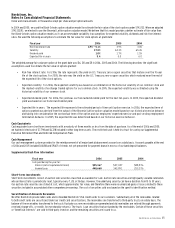

Income Taxes

We use the asset and liability method of accounting for income taxes. Using this method, deferred tax assets and liabilities are recorded based on

differences between financial reporting and tax basis of assets and liabilities. The deferred tax assets and liabilities are calculated using the enacted

tax rates and laws that are expected to be in effect when the differences are expected to reverse. We establish valuation allowances for tax benefits

when we believe it is not likely that the related expense will be deductible for tax purposes.

Other Current Liabilities

Included in other current liabilities were gift card liabilities of $171,631 and $154,683 at the end of 2006 and 2005.