Nordstrom 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

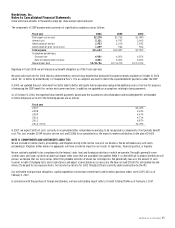

NOTE 12: SHAREHOLDERS’ EQUITY AND STOCK COMPENSATION PLANS

Share Repurchase Program

In August 2004, our Board of Directors authorized $300,000 of share repurchases, replacing a previous share repurchase authorization. By the end

of 2004, we purchased 13,815 shares in the open market for the entire authorized amount of $300,000 at an average price of $21.71 per share.

In February 2005, our Board of Directors authorized an additional $500,000 of share repurchases. In 2005, we purchased 8,494 shares for $287,080

at an average price of $33.80 per share. We utilized the remainder of this authorization of $212,920 in the first quarter of 2006, purchasing 5,422

shares at an average price of $39.27 per share.

In May 2006, our Board of Directors authorized additional share repurchases of $1,000,000. In 2006, we repurchased 11,123 shares under this

authorization for $408,607 at an average price of $36.74. As of February 3, 2007, the unused authorization was $591,394. The actual amount and timing

of future share repurchases will be subject to market conditions and applicable SEC rules.

Dividends

In 2006, we paid dividends of $0.42 per share, the tenth consecutive year that our annual dividends increased. We paid dividends of $0.32 and $0.24 in

2005 and 2004.

Stock Option Plans

In 2004, our shareholders approved the 2004 Equity Incentive Plan. We currently grant stock options, performance share units and common shares

under this plan.

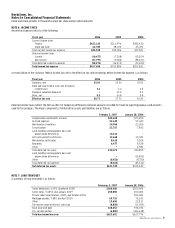

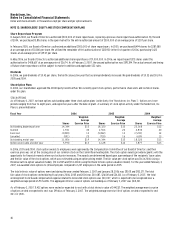

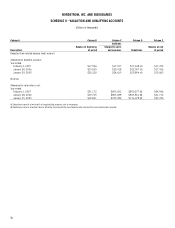

STOCK OPTIONS

As of February 3, 2007, we have options outstanding under three stock option plans (collectively, the “Nordstrom, Inc. Plans”). Options vest over

periods ranging from four to eight years, and expire ten years after the date of grant. A summary of stock option activity under the Nordstrom, Inc.

Plans is presented below:

Fiscal Year

2006

2005

2004

Shares

Weighted-

Average

Exercise Price

Shares

Weighted-

Average

Exercise Price

Shares

Weighted-

Average

Exercise Price

Outstanding, beginning of year

14,344

$15

18,320

$13

23,368

$12

Granted

1,941

40

2,564

26

2,830

20

Exercised

(3,838)

13

(5,822)

13

(7,239)

12

Cancelled

(591)

25

(718)

16

(639)

13

Outstanding, end of year

11,856

$19

14,344

$15

18,320

$13

Options exercisable at end of year

5,990

$13

6,128

$12

7,877

$13

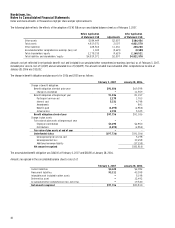

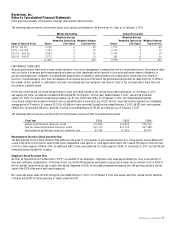

In 2006, 2005 and 2004, stock option awards to employees were approved by the Compensation Committee of our Board of Directors and their

exercise price was set at the closing price of our common stock on the Committee meeting date. The stock option awards provide recipients with the

opportunity for financial rewards when our stock price increases. The awards are determined based upon a percentage of the recipients’ base salary

and the fair value of the stock options, which was estimated using an option pricing model. The fair value per stock option was $16 in 2006 (using a

Binomial Lattice option valuation model), $10 in 2005 and $11 in 2004 (using the Black-Scholes option valuation model). For the year ended February 3,

2007, we awarded stock options to 1,236 employees compared to 1,207 employees in the same period in 2005.

The total intrinsic value of options exercised during the years ended February 3, 2007 and January 28, 2006 was $111,011 and $102,371. The total

fair value of stock options vested during fiscal years 2006, 2005 and 2004 was $30,087, $26,541 and $24,333. As of February 3, 2007, the total

unrecognized stock-based compensation expense related to nonvested stock options was $40,007, which is expected to be recognized over a

weighted average period of 29 months. The aggregate intrinsic value of options outstanding as of February 3, 2007 was $441,321.

As of February 3, 2007, 11,432 options were vested or expected to vest with a total intrinsic value of $441,321. The weighted average exercise price

of options vested or expected to vest was $19.46 as of February 3, 2007. The weighted average exercise life of options vested or expected to vest

was six years.