Nordstrom 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 23

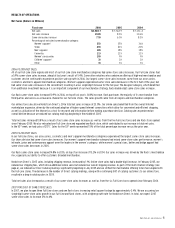

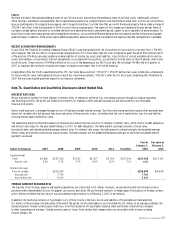

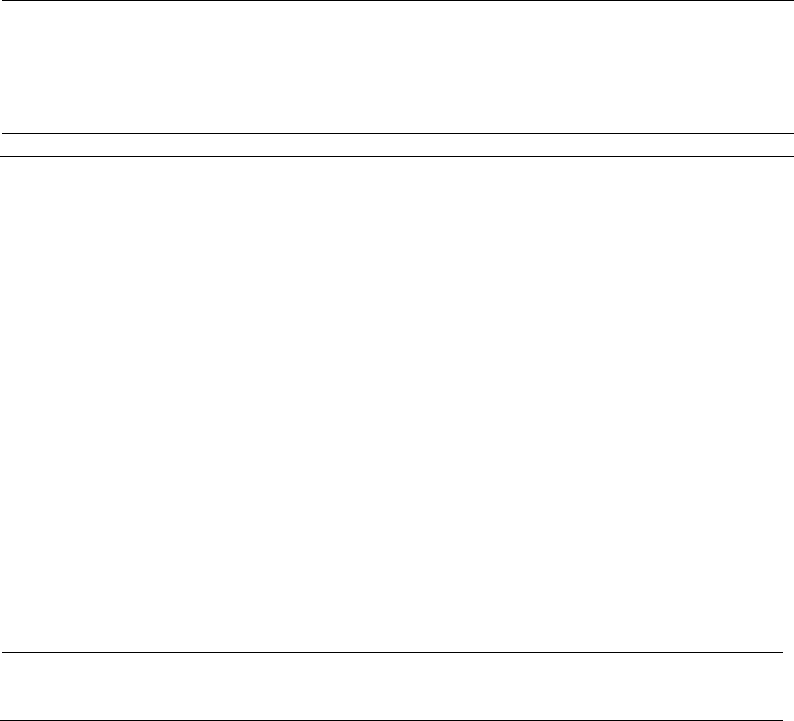

Credit Capacity and Commitments (Dollars in Millions)

The following table summarizes our amount of commitment expiration per period:

Total

Amounts

Committed

Less than

1 year

1–3 years

3–5 years

More than

5 years

Other commercial commitments

$600.0 variable funding note

$350.0

$350.0

—

—

—

$500.0 unsecured line of credit,

none outstanding

-

—

—

—

—

Standby letters of credit

-

-

—

—

—

Import letters of credit

9.8

9.8

—

—

—

Total

$359.8

$359.8

—

—

—

In June and October 2006, we amended our existing variable funding facility backed by Nordstrom private label card and VISA credit card receivables

to increase the capacity of this facility to $600.0. Borrowings under the facility will incur interest based upon the actual cost of commercial paper

plus specified fees ranging from 0.075% to 0.15%. As of February 3, 2007, the facility’s interest rate was 5.42%. We pay a commitment fee ranging

from 0.125% to 0.15% for the note based on the amount of the commitment. Fee rates decrease if more than $50,000 is outstanding on the facility.

The facility can be cancelled or not renewed if our debt ratings fall below Standard and Poor’s BB+ rating or Moody’s Ba1 rating.

In November 2005, we replaced our existing $350.0 unsecured line of credit with a $500.0 unsecured line of credit, which is available as liquidity

support for our commercial paper program. Under the terms of the agreement, we pay a variable rate of interest and a commitment fee based on our

debt rating. Based upon our current debt rating, we pay a variable rate of interest of LIBOR plus a margin of 0.225% (5.62% at February 3, 2007) on

the outstanding balance and an annual commitment fee of 0.075% on the total capacity. The variable rate of interest increases to LIBOR plus a

margin of 0.325% if more than $250.0 is outstanding on the facility. The line of credit expires in November 2010, and contains restrictive covenants,

which include maintaining a leverage ratio. We did not make any borrowings under this unsecured line of credit during the last three fiscal years.

We also have universal shelf registrations on file with the Securities and Exchange Commission that permit us to offer an additional $450.0

of securities to the public. These registration statements allow us to issue various types of securities, including debt, common stock, warrants

to purchase common stock, warrants to purchase debt securities and warrants to purchase or sell foreign currency.

Debt Ratings

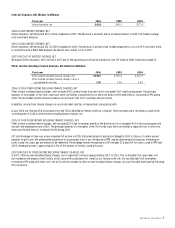

The following table shows our credit ratings at the date of this report:

Credit Ratings

Moody’s

Standard

and Poor’s

Senior unsecured debt

Baa1

A

Commercial paper

P-2

A-1

Outlook

Positive

Stable

These ratings could change depending on our performance and other factors. Our outstanding debt is not subject to termination or interest rate

adjustments based on changes in our credit ratings.

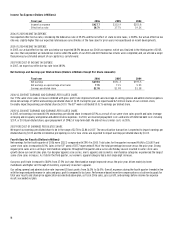

Dividends

In February 2007 we declared a quarterly dividend of $0.135 per share, increased from $0.105 per share in the prior year.

In 2006, we paid dividends of $0.42 per share, the tenth consecutive year that our annual dividends increased. We paid dividends of $0.32 and $0.24 in

2005 and 2004. In determining the amount of dividends to pay, we analyze our dividend payout ratio, dividend yield and balance the dividend payment

with our operating performance and capital resources. We target a dividend payout ratio of approximately 18% to 20% of net income, although the

ratio has been slightly lower the last two years as a result of the significant increase in our net earnings. For the dividend yield, which is calculated as

our dividends per share divided by our stock price, we target a 1% long-term yield. While we plan to increase dividends over time, we will balance

future increases with our operating performance and available capital resources.

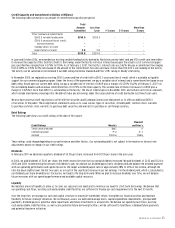

Liquidity

We maintain a level of liquidity to allow us to cover our seasonal cash needs and to minimize our need for short-term borrowings. We believe that

our operating cash flows, existing cash and available credit facilities are sufficient to finance our cash requirements for the next 12 months.

Over the long term, we manage our cash and capital structure to maximize shareholder return, strengthen our financial position and maintain

flexibility for future strategic initiatives. We continuously assess our debt and leverage levels, capital expenditure requirements, principal debt

payments, dividend payouts, potential share repurchases and future investments or acquisitions. We believe our operating cash flows, existing

cash and available credit facilities, as well as any potential future borrowing facilities, will be sufficient to fund these scheduled future payments

and potential long-term initiatives.