Nordstrom 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

In 2000, the company acquired Façonnable, S.A.S., a collection of high-quality men’s, women’s and boys’ apparel and accessories. In February 2007,

we announced that we are exploring strategic options that would benefit both Nordstrom and Façonnable, including a possible sale of the brand.

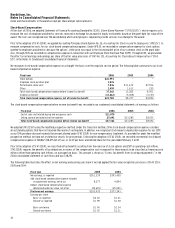

CRITICAL ACCOUNTING POLICIES

The preparation of our financial statements requires that we make estimates and judgments that affect the reported amounts of assets, liabilities,

revenues and expenses, and disclosure of contingent assets and liabilities. We base our estimates on historical experience and on other assumptions

that we believe to be reasonable under the circumstances. Actual results may differ from these estimates. The following discussion highlights the

policies we feel are critical.

Off-Balance Sheet Financing

Our co-branded Nordstrom VISA credit card receivables are transferred to a third-party trust on a daily basis. The balance of the receivables

transferred to the trust fluctuates as new receivables are generated and old receivables are retired (through payments received, charge-offs,

or credits from merchandise returns). The trust issues securities that are backed by the receivables. Certain of these securities or “beneficial

interests” are sold to third-party investors and those remaining securities are issued to us.

We recognize gains or losses on the sale of the co-branded Nordstrom VISA receivables to the trust based on the difference between the face value of

the receivables sold and the estimated fair value of the assets created in the securitization process. The fair value of the assets is calculated as the

present value of their expected cash flows. The discount rate used to calculate fair value represents the volatility and risk of the assets. Assumptions

and judgments are made to estimate the fair value of our investment in asset backed securities. We have no other off-balance sheet transactions.

Inventory

Our merchandise inventories are primarily stated at the lower of cost or market using the retail inventory method (first-in, first-out basis). Under the

retail method, the valuation of inventories and the resulting gross margins are determined by applying a calculated cost-to-retail ratio to the retail

value of ending inventory. To determine if the retail value of our inventory should be marked down, we consider current and anticipated demand,

customer preferences, age of the merchandise and fashion trends. As our inventory retail value is adjusted regularly to reflect market conditions, our

inventory is valued at the lower of cost or market.

We also reserve for obsolescence based on historical trends and specific identification. Shrinkage is estimated as a percentage of net sales for the

period from the most recent semi-annual inventory count based on historical shrinkage results.

Revenue Recognition

We recognize revenues net of estimated returns and we exclude sales taxes. Our retail stores record revenue at the point of sale. Our catalog and

online sales include shipping revenue and are recorded upon estimated delivery to the customer. As part of the normal sales cycle, we receive

customer merchandise returns. To recognize the financial impact of sales returns, we estimate the amount of goods that will be returned and reduce

sales and cost of sales accordingly. We utilize historical return patterns to estimate our expected returns.

Vendor Allowances

We receive allowances from merchandise vendors for purchase price adjustments, cooperative advertising programs, cosmetic selling expenses and

vendor sponsored contests. Purchase price adjustments are recorded as a reduction of cost of sales after an agreement with the vendor is executed

and the related merchandise has been sold. Allowances for cooperative advertising programs and vendor sponsored contests are recorded in cost of

sales and selling, general and administrative expenses as a reduction to the related cost when incurred. Allowances for cosmetic selling expenses are

recorded in selling, general and administrative expenses as a reduction to the related cost when incurred. Any allowances in excess of actual costs

are recorded as a reduction to cost of sales.

Self Insurance

We retain a portion of the risk for certain losses related to health and welfare, workers’ compensation and general liability claims. Liabilities

associated with these losses include estimates of both losses reported and losses incurred but not yet reported. We estimate our ultimate cost based

on internal analysis of historical data and independent actuarial estimates. Favorable trends in California caused a decrease in our workers’

compensation costs in 2005.

Allowance for Doubtful Accounts

Our allowance for doubtful accounts represents our best estimate of the losses inherent in our private label credit card receivable as of the balance

sheet date. We evaluate the collectibility of our accounts receivable based on several factors, including historical trends of aging of accounts,

write-off experience and expectations of future performance. We recognize finance charges on delinquent accounts until the account is written off.

Delinquent accounts are written off when they are determined to be uncollectible, usually after the passage of 151 days without receiving a full

scheduled monthly payment. Accounts are written off sooner in the event of customer bankruptcy or other circumstances that make further

collection unlikely.

Intangible Asset Impairment Testing

We review our goodwill and acquired tradename annually for impairment in the first quarter or when circumstances indicate the carrying value

of these assets may not be recoverable. The goodwill and acquired tradename associated with our Façonnable business are our largest impairment

risk. The fair value of our intangible assets has exceeded their carrying value in each of the most recent three years.