Nordstrom 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 25

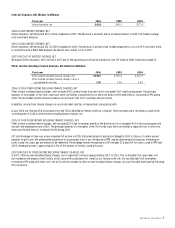

Leases

We lease the land or the land and building at many of our Full-Line stores, and we lease the building at many of our Rack stores. Additionally, we lease

office facilities, warehouses and equipment. We recognize lease expense on a straight-line basis over the minimum lease term. In 2004, we corrected our

lease accounting policy to recognize lease expense, net of property incentives, from the time that we control the leased property. We recorded a charge of

$7.8 ($4.7 net of tax) in the fourth quarter of 2004 to correct this accounting policy. The impact of this change was immaterial to prior periods. Many of

our leases include options that allow us to extend the lease term beyond the initial commitment period, subject to terms agreed to at lease inception. For

leases that contain rent holiday periods and scheduled rent increases, we record the difference between the rent expense and the rental amount payable

under the leases in liabilities. Some leases require additional payments based on sales and are recorded in rent expense when the contingent rent is probable.

RECENT ACCOUNTING PRONOUNCEMENTS

In July 2006, the Financial Accounting Standards Board (FASB) issued Interpretation No. 48,

Accounting for Uncertainty in Income Taxes

(“FIN 48”),

which requires that the tax effects of a position be recognized only if it is more likely than not to be sustained on audit, based on the technical merits

of the position. FIN 48 also provides guidance on derecognition of income tax assets and liabilities, classification of current and deferred income tax

assets and liabilities, accounting for interest and penalties associated with tax positions, accounting for income taxes in interim periods, and income

tax disclosures. The provisions of FIN 48 are effective for us as of the beginning of our 2007 fiscal year. We will adopt FIN 48 in the first quarter of

2007, as required. We continue to evaluate the impact of adoption, but expect that it will not be material.

In September 2006, the FASB issued Statement No. 157,

Fair Value Measurements

(“SFAS 157”). SFAS 157 defines fair value, establishes a framework

for measuring fair value, and expands disclosures about fair value measurements. SFAS 157 is effective for fiscal years beginning after November 15,

2007. We are assessing the potential impact on our financial statements.

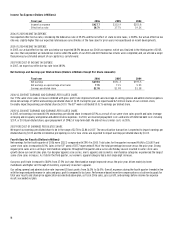

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

INTEREST RATE RISK

We are exposed to market risk from changes in interest rates. In seeking to minimize risk, we manage exposure through our regular operating

and financing activities. We do not use financial instruments for trading or other speculative purposes and are not party to any leveraged

financial instruments.

Interest rate exposure is managed through our mix of fixed and variable rate borrowings. Short-term borrowing and investing activities generally bear

interest at variable rates, but because they have maturities of three months or less, we believe that the risk of material loss was low, and that the

carrying amount approximated fair value.

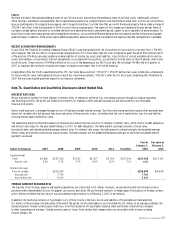

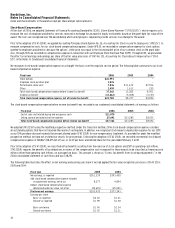

The table below presents information about our financial instruments that are sensitive to changes in interest rates, which consist of debt obligations

and interest rate swaps for the year ended February 3, 2007. For debt obligations, the table presents principal amounts, at book value,

by maturity date, and related weighted average interest rates. For interest rate swaps, the table presents notional amounts and weighted average

interest rates by expected (contractual) maturity dates. Notional amounts are the predetermined dollar principal on which the exchanged interest

payments are based.

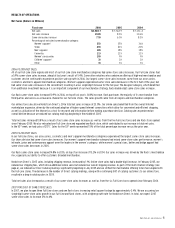

Dollars in thousands

2007

2008

2009

2010

2011

Thereafter

Total at

February 3,

2007

Fair value at

February 3,

2007

Long-term debt

Fixed

$6,800

$257,030

$7,043

$5,427

$5,764

$357,244

$639,308

$667,191

Avg. int. rate

8.0%

5.7%

7.7%

8.9%

8.7%

7.1%

6.6%

Interest rate swap

Fixed to variable

—

$250,000

—

—

—

$250,000

$(8,858)

Avg. pay rate

—

7.70%

—

—

—

7.70%

Avg. receive rate

—

5.63%

—

—

—

5.63%

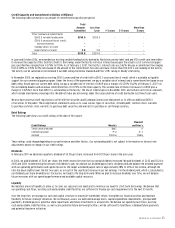

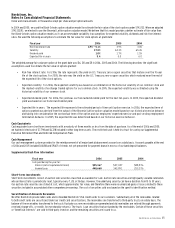

FOREIGN CURRENCY EXCHANGE RISK

The majority of our revenue, expense and capital expenditures are transacted in U.S. dollars. However, we periodically enter into foreign currency

purchase orders denominated in Euros for apparel, accessories and shoes. We use forward contracts to hedge against fluctuations in foreign currency

prices. We do not believe the fair value of our outstanding forward contracts at February 3, 2007 to be material.

In addition, the functional currency of Façonnable, S.A.S. of Nice, France is the Euro. Assets and liabilities of Façonnable are translated into

U.S. dollars at the exchange rate prevailing at the end of the period. Income and expenses are translated into U.S. dollars at an average exchange rate

during the period. Foreign currency gains and losses from the translation of Façonnable’s balance sheet and income statement are included

in other comprehensive earnings. Foreign currency gains or losses from certain intercompany loans are recorded in other income including

finance charges, net.