Nordstrom 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

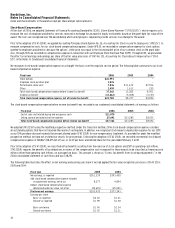

Stock-Based Compensation

At the start of 2006, we adopted Statement of Financial Accounting Standard No. 123(R),

Share-Based Payment

(“SFAS 123(R)”), which requires us to

measure the cost of employee and director services received in exchange for an award of equity instruments based on the grant-date fair value of the

award. The costs are recognized over the period during which an employee is required to provide services in exchange for the award.

Prior to the adoption of SFAS 123(R), we applied Accounting Principles Board Opinion No. 25,

Accounting for Stock Issued to Employees

(“APB 25”), to

measure compensation costs for our stock-based compensation programs. Under APB 25, we recorded no compensation expense for stock options

granted to employees and directors because the options’ strike price was equal to the closing market price of our common stock on the grant date.

Also, through 2005 we recorded no compensation expense in connection with our Employee Stock Purchase Plan (ESPP). Through 2005, we presented

the effect on net earnings and earnings per share of the fair value provisions of SFAS No. 123,

Accounting for Stock-Based Compensation

(“SFAS

123”) in the Notes to Condensed Consolidated Financial Statements.

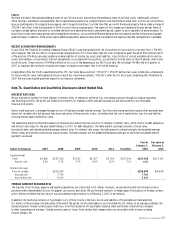

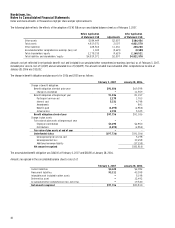

We recognize stock-based compensation expense on a straight-line basis over the requisite service period. The following table summarizes our stock-

based compensation expense:

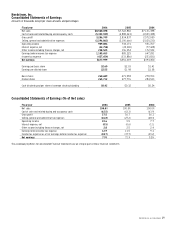

Fiscal year

2006

2005

2004

Stock options

$26,991

-

-

Employee stock purchase plan

1,876

-

-

Performance share units

7,036

$11,672

$7,816

Other

1,459

1,613

235

Total stock-based compensation expense before income tax benefit

37,362

13,285

8,051

Income tax benefit

(13,662)

(5,008)

(3,157)

Total stock-based compensation expense, net of income tax benefit

$23,700

$8,277

$4,894

The stock-based compensation expense before income tax benefit was recorded in our condensed consolidated statements of earnings as follows:

Fiscal year

2006

2005

2004

Cost of sales and related buying and occupancy costs

$11,870

-

-

Selling, general and administrative expenses

25,492

$13,285

$8,051

Total stock-based compensation expense before income tax benefit

$37,362

$13,285

$8,051

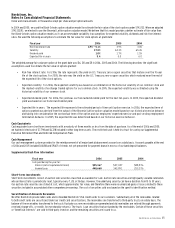

We adopted SFAS 123(R) using the modified prospective method. Under this transition method, 2006 stock-based compensation expense considers

all outstanding options that have not reached their earliest vesting date. In addition, we recognized stock-based compensation expense for our ESPP,

as our 10% purchase discount exceeds the amount allowed under SFAS 123(R) for non-compensatory treatment. As provided for under the modified

prospective method, we have not restated our results for prior periods. Following the adoption of SFAS 123(R), we recorded incremental stock-based

compensation expense of $28,867 ($18,475 net of tax), or $0.07 per basic and diluted share for the year ended February 3, 2007.

Prior to the adoption of SFAS 123(R), we classified all tax benefits resulting from the exercise of stock options and ESPP as operating cash inflows.

SFAS 123(R) requires the benefits of tax deductions in excess of the compensation cost recognized for those awards to be classified as financing cash

inflows rather than operating cash inflows, on a prospective basis. This amount is shown as “Excess tax benefit from stock-based payments” in the

2006 consolidated statement of cash flows and was $38,293.

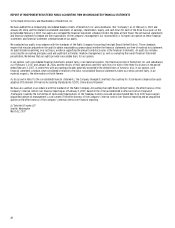

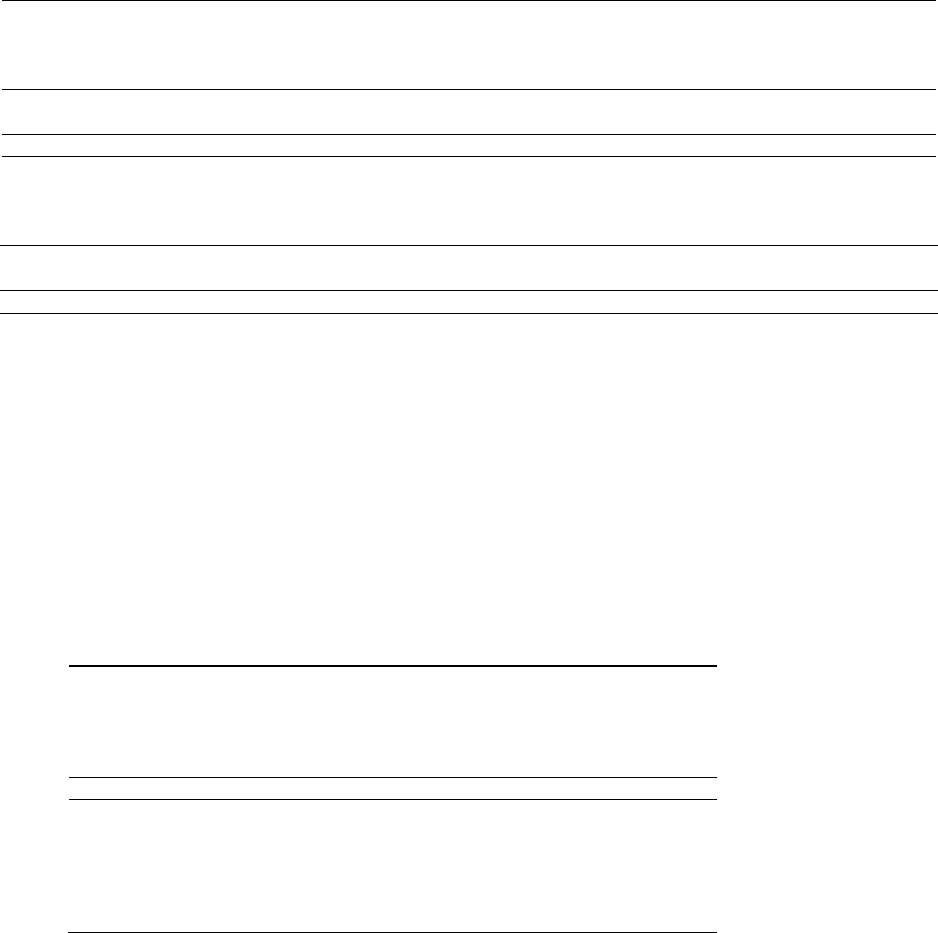

The following table illustrates the effect on net earnings and earnings per share if we had applied the fair value recognition provisions of SFAS 123 in

2005 and 2004:

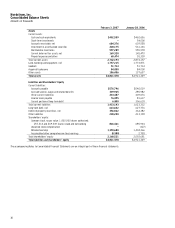

Fiscal year

2005

2004

Net earnings, as reported

$551,339

$393,450

Add: stock-based compensation expense included

in reported net earnings, net of tax

8,277

4,894

Deduct: stock-based compensation expense

determined under fair value, net of tax

(25,681)

(25,001)

Pro forma net earnings

$533,935

$373,343

Earnings per share:

Basic-as reported

$2.03

$1.41

Diluted-as reported

$1.98

$1.38

Basic-pro forma

$1.96

$1.34

Diluted-pro forma

$1.92

$1.31