Nordstrom 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

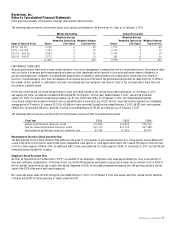

We retired the $300,000 Private Label Securitization debt when it matured in October 2006.

Our mortgage payable is secured by an office building which had a net book value of $76,643 at the end of 2006.

To manage our interest rate risk, we have an interest rate swap outstanding recorded in other liabilities. Our swap has a $250,000 notional amount,

expires in January 2009 and is designated as a fully effective fair value hedge. Under the agreement, we receive a fixed rate of 5.63% and pay a

variable rate based on LIBOR plus a margin of 2.3% set at six-month intervals (7.70% at February 3, 2007).

The fair value of long-term debt, including current maturities, using quoted market prices of the same or similar issues, was $667,191 and $963,092

at the end of 2006 and 2005.

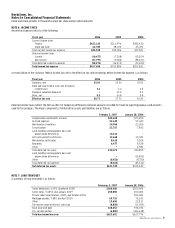

Required principal payments on long-term debt, excluding capital lease obligations and the fair market value of the interest rate swap, are as follows:

Fiscal year

2007

$5,843

2008

255,911

2009

6,355

2010

4,751

2011

5,167

Thereafter

352,766

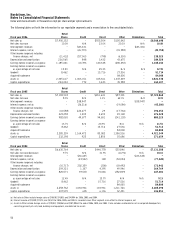

In November 2005, we replaced our existing $350,000 unsecured line of credit with a $500,000 unsecured line of credit, which is available as

liquidity support for our commercial paper program. Under the terms of the agreement, we pay a variable rate of interest and a commitment fee

based on our debt rating. Based upon our current debt rating, we pay a variable rate of interest of LIBOR plus a margin of 0.225% (5.62% at February

3, 2007) on the outstanding balance and an annual commitment fee of 0.075% on the total capacity. The variable rate of interest increases to LIBOR

plus a margin of 0.325% if more than $250,000 is outstanding on the facility. The line of credit expires in November 2010, and contains restrictive

covenants, which include maintaining a leverage ratio. We did not make any borrowings under this unsecured line of credit during 2006 or 2005.

In 2006, we renewed our existing variable funding facility backed by Nordstrom private label card and VISA credit card receivables and increased the

capacity of this facility from $150,000 to $600,000. The annual renewal of this note requires both our approval and our issuing bank’s approval and

interest is paid based on the actual cost of commercial paper plus specified fees ranging from 0.075% to 0.15%. As of February 3, 2007, the facility’s

interest rate was 5.42%. We also pay a commitment fee ranging from 0.125% to 0.15% for the note based on the amount of the commitment. Fee

rates decrease if more than $50,000 is outstanding on the facility. The facility can be cancelled and renewal can be denied if our debt ratings fall

below Standard and Poor’s BB+ rating or Moody’s Ba1 rating. Our current rating by Standard and Poor’s is A, five grades above BB+, and by Moody’s

is Baa1, three grades above Ba1.

In July 2006, the VISA Trust used this variable funding facility to issue $300,000 of Notes; in September 2006, the VISA Trust used this facility

to issue an additional $50,000 of Notes. As the VISA Trust is a statutory business trust and the VISA credit card receivables transferred to it are

accounted for as a sale under SFAS 140, the obligations of the VISA Trust are not recorded in our financial statements. The VISA Trust sent the

proceeds from this note issuance to us in return for a reduction in our interest in the VISA Trust equal to a $350,000 decrease in our share of the

principal balance of VISA credit card receivables in 2006.

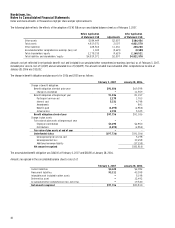

The components of interest expense, net are as follows:

Fiscal year

2006

2005

2004

Interest expense on long-term debt

$62,409

$63,378

$88,518

Less:

Interest income

(14,654)

(13,273)

(7,929)

Capitalized interest

(4,997)

(4,805)

(3,161)

Interest expense, net

$42,758

$45,300

$77,428