Nordstrom 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

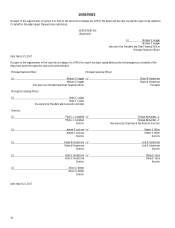

Nordstrom, Inc. and subsidiaries 49

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in thousands except per share and per option amounts

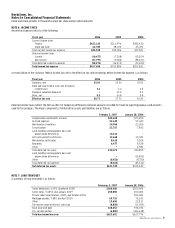

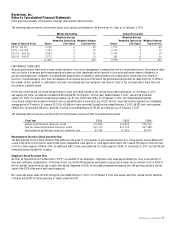

The following table summarizes the net sales by merchandise category:

Fiscal year

2006

2005

2004

Women’s apparel

$2,963,134

$2,709,563

$2,577,489

Shoes

1,731,278

1,590,877

1,454,415

Men’s apparel

1,561,175

1,388,713

1,250,546

Cosmetics

941,541

847,391

767,132

Women’s accessories

847,334

720,334

636,227

Children’s apparel

286,153

266,225

246,079

Other

230,083

199,757

199,500

Total

$8,560,698

$7,722,860

$7,131,388

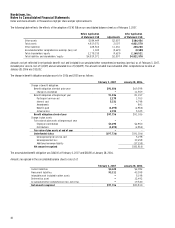

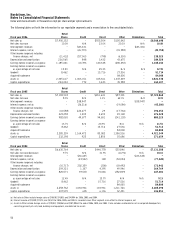

The following table presents our sales by merchandise category as a percentage of net sales:

Fiscal year

2006

2005

2004

Women’s apparel

35%

35%

36%

Shoes

20%

21%

20%

Men’s apparel

18%

18%

18%

Cosmetics

11%

11%

11%

Women’s accessories

10%

9%

9%

Children’s apparel

3%

3%

3%

Other

3%

3%

3%

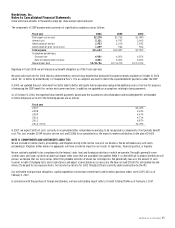

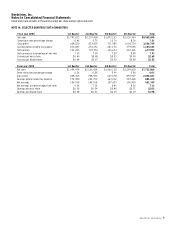

In general, we use the same measurements to compute earnings before income tax expense for reportable segments as we do for the consolidated

company. However, redemptions of our merchandise rewards certificates are included in net sales for our Retail Stores segment. The sales amount

in our Other segment includes an entry to eliminate these transactions from our consolidated net sales. There is no impact to earnings before income

tax expense for this adjustment. In addition, our sales return reserve for our Retail Stores segment is recorded in the Other segment. Other than

described above, the accounting policies of the operating segments are the same as those described in the summary of significant accounting policies

in Note 1.