Nordstrom 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

Item 3. Legal Proceedings.

COSMETICS

We were originally named as a defendant along with other department store and specialty retailers in nine separate but virtually identical class

action lawsuits filed in various Superior Courts of the State of California in May, June and July 1998 that were consolidated in Marin County Superior

Court. In May 2000, plaintiffs filed an amended complaint naming a number of manufacturers of cosmetics and fragrances and two other retailers as

additional defendants. Plaintiffs’ amended complaint alleged that the retail price of the “prestige” or “Department Store” cosmetics and fragrances

sold in department and specialty stores was collusively controlled by the retailer and manufacturer defendants in violation of the Cartwright Act and

the California Unfair Competition Act.

Plaintiffs sought treble damages and restitution in an unspecified amount, attorneys’ fees and prejudgment interest, on behalf of a class of all

California residents who purchased cosmetics and fragrances for personal use from any of the defendants during the four years prior to the filing

of the original complaints.

While we believe that the plaintiffs’ claims are without merit, we entered into a settlement agreement with the plaintiffs and the other defendants on

July 13, 2003 in order to avoid the cost and distraction of protracted litigation. In furtherance of the settlement agreement, the case was re-filed in

the United States District Court for the Northern District of California on behalf of a class of all persons who currently reside in the United States and

who purchased “Department Store” cosmetics and fragrances from the defendants during the period May 29, 1994 through July 16, 2003. The Court

gave preliminary approval to the settlement, and a summary notice of class certification and the terms of the settlement was disseminated to class

members. On March 30, 2005, the Court entered a final judgment approving the settlement and dismissing the plaintiffs’ claims and the claims of all

class members with prejudice, in their entirety. On April 29, 2005, two class members who had objected to the settlement filed notices of appeal

from the Court’s final judgment to the United States Court of Appeals for the Ninth Circuit. One of the objectors has since dropped her appeal, but the

other filed her appeal brief on March 20, 2006. Plaintiffs’ and defendants’ briefs were filed on May 25, 2006. The remaining objector filed her reply

brief on June 14, 2006. The Ninth Circuit heard oral arguments on the appeal on March 14, 2007. It is uncertain how long the Ninth Circuit will take to

issue its decision or when the appeal will be resolved. If the District Court’s final judgment approving the settlement is affirmed on appeal, or the

appeal is dismissed, the defendants will provide class members with certain free products with an estimated retail value of $175 million and pay the

plaintiffs’ attorneys’ fees, awarded by the Court, of $24 million. We do not believe the outcome of this matter will have a material adverse effect on

our financial condition, results of operations or cash flows.

OTHER

We are involved in routine claims, proceedings, and litigation arising from the normal course of our business. We do not believe any such claim,

proceeding or litigation, either alone or in aggregate, will have a material impact on our financial condition, results of operations, or cash flows.

Item 4. Submission of Matters to a Vote of Security Holders.

None.

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of

Equity Securities.

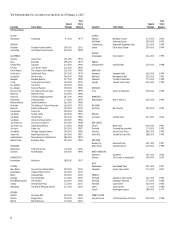

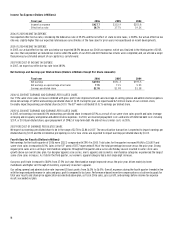

MARKET, SHAREHOLDER, AND DIVIDEND INFORMATION

Our common stock, without par value, is traded on the New York Stock Exchange under the symbol “JWN.” The approximate number of holders

of common stock as of March 14, 2007 was 151,926, based upon the number of registered and beneficial shareholders, as well as the number of

employee shareholders in the Nordstrom 401(k) Plan and Profit Sharing.

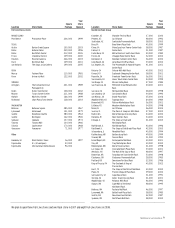

The high and low sales prices of our common stock and dividends declared for each quarter of 2006 and 2005 are presented in the table below:

Common Stock Price

2006

2005

Dividends per Share

High

Low

High

Low

2006

2005

1st Quarter

$42.90

$37.51

$28.14

$23.91

$0.105

$0.065

2nd Quarter

$39.50

$31.77

$37.46

$25.22

$0.105

$0.085

3rd Quarter

$49.52

$32.97

$37.96

$30.41

$0.105

$0.085

4th Quarter

$57.10

$45.37

$42.74

$33.58

$0.105

$0.085

Full Year

$57.10

$31.77

$42.74

$23.91

$0.42

$0.32